Calm Down and Keep Executing

Analysing the Progress of Semiconductor-related Policies through Budgetary Allocations

Authors

The latest union budget speech mentions that the government plans to launch a second version of the India Semiconductor Mission. As four years have passed since the launch of India Semiconductor Mission 1.0, now is a good time to assess progress using the government’s own spending data. And to make a fair assessment, we must go beyond speeches and announcements.

Thus, I looked up the budget data for all the years since the policy came into effect, and the results suggest a huge gap between promise and delivery.

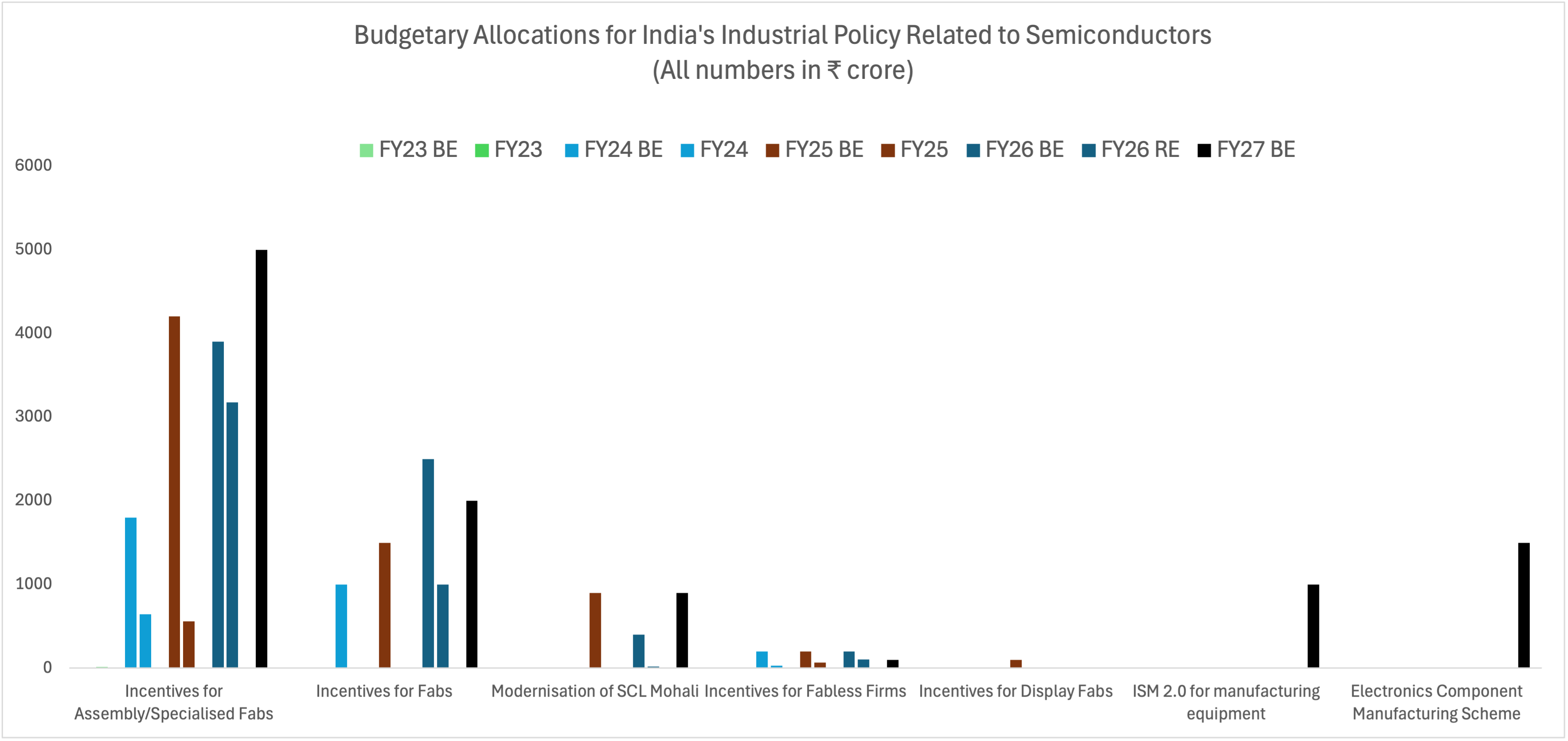

The chart above shows all budgeted and disbursed amounts to date. Every financial year has two bars of the same colour. The first bar shows the expenditure forecast for the beginning of that year (also called budgeted estimates, or BE). The second bar of the same colour shows the actual disbursements at the end of that financial year (actuals). The difference between ex-ante budget allocation vs actual spending is especially important because the policies have front-loaded the disbursement on an equal footing basis during capital acquisition and construction stages, instead of making financial support incumbent on production.

In FY27, the government expects to spend ₹8000 crore (~10 per cent of the total outlay) for the already approved projects under ISM1.0. Breaking down this overall number indicates the health of each sub-scheme.

- The one area which seems to be proceeding well is the scheme for chip assembly and testing. While there is still a vast gap between the budgeted estimates and disbursals, the steady rise in disbursements in absolute terms indicates on-ground progress.

- The budgeted outlay for a fab shows a muted picture. Despite the budgeted allocations for the Dholera fab in FY24 and FY25, not a single penny was disbursed. The FY26 revised estimate is also substantially lower than the budgeted allocations. Thus, it indicates that the project is progressing much more slowly than the government’s own projections.

- Next, the government has been planning to modernise the government-owned R&D fabrication unit in Mohali this year without much success. Despite allocating money for it in several budgets, virtually nothing has been spent yet.

- The sad disappointing concerns a sector where India’s comparative advantage actually lies, i.e., fabless firms. The Design-linked incentive promised to support 100 start-ups in their go-to-market strategy, but the disbursals show how far off the target the scheme is. There was no disbursement in FY23; The FY24 disbursements were 15 per cent of the budgeted allocation of ₹200 crore; the FY25 disbursements stood at 34 per cent of the budgeted expense; and the FY26 disbursements stood at 52 per cent. In FY27, the budgeted expenditure is ₹100 crore. The reasons for tardiness include strict provisions that put firms raising substantial foreign money out of contention, confusion on the government’s right to the company’s intellectual property, and entrusting a government company, which is also a player in this domain, as the nodal regulator of this scheme.

- The display fab scheme hasn’t attracted any interest, and the government hasn’t budgeted any amount for it this year either. I have long argued that display fabs are not strategic, and spending taxpayer money on them merely to reduce imports from China is not sensible. Good riddance if the government stops wasting time, money, and effort here. Let private players build these display fabs on their own dime. Provide reliable electricity and reliable land titles instead.

- The headline announcement is India Semiconductor Mission 2.0. The new mission aims to move beyond fab construction to focus on semiconductor equipment, materials, and full-stack Indian IP development. A budget of ₹1,000 crore has been allocated for FY27, indicating a gradual ramp-up.

- A related scheme is the Electronics Component Manufacturing Scheme. The Finance Minister announced that there was a high demand for this scheme and hence the outlay for this scheme was raised to ₹40,000 crore from ₹22000 crore. Here again, the government is planning a spend of ₹1500 crore in the next financial year.

I have outlined problems with the Design-linked Incentive Scheme here

To summarise, India’s semiconductor journey remains a work in progress. The assembly segment shows genuine momentum, but fab construction is behind schedule, SCL Mohali modernisation remains more promise than reality, and the design ecosystem—where India has natural strengths—continues to be let down by poorly designed incentive structures. ISM 2.0’s focus on equipment and materials is strategically sensible, but execution will be key. As with previous years, the gap between announcements and allocations, between budgeted amounts and revised estimates, tells the real story.