China’s Green Hydrogen Landscape

Mapping Provincial Pathways and Central Policies

Authors

Executive Summary

China is applying its proven strategy of massive capacity building, subsidies, and tax incentives to green hydrogen—positioning itself to dominate the industry, as it did with electric vehicles. Current policies emphasise boosting domestic adoption, testing technologies, and proving commercial viability. China undeniably plays a pivotal role in the global hydrogen landscape, accounting for one-third of the world’s total hydrogen demand. This scale gives it a unique leverage to shape the global transition toward green hydrogen.

On the equipment side, China leads in low-cost alkaline electrolyser manufacturing—supplying the bulk of global capacity, despite efficiency trade-offs. Provincial demonstration projects—from renewable-powered hydrogen hubs to industrial decarbonisation pilots—are driving innovation and testing commercial models. Together, these efforts highlight China’s pivotal role in accelerating green hydrogen adoption while also exposing the challenges of technology efficiency, storage, and transport that still stand in the way.

1. Introduction

To overcome China’s status as the world’s largest carbon emitter, Chinese policymakers are prioritising climate change mitigation strategies. Key to achieving its targets, without compromising on energy goals, is the ‘1 + N’ policy framework which is a tiered approach to direct efforts towards decarbonisation.1 The ‘1’ in the framework is the guiding idea setting overarching targets and timelines for China’s ‘dual-carbon’ goals. The ‘N’ in the framework refers to specific implementation schemes and action plans in various green energy sectors. The 14th Five-Year Plan aimed to reduce the country’s carbon intensity levels by 18% between 2020-2025. By the end of 2024, a 12% reduction in carbon intensity levels was achieved.2 In order to achieve further targets, the adoption of ‘low-carbon yet high-efficiency’ fuels, such as hydrogen, plays an important role.

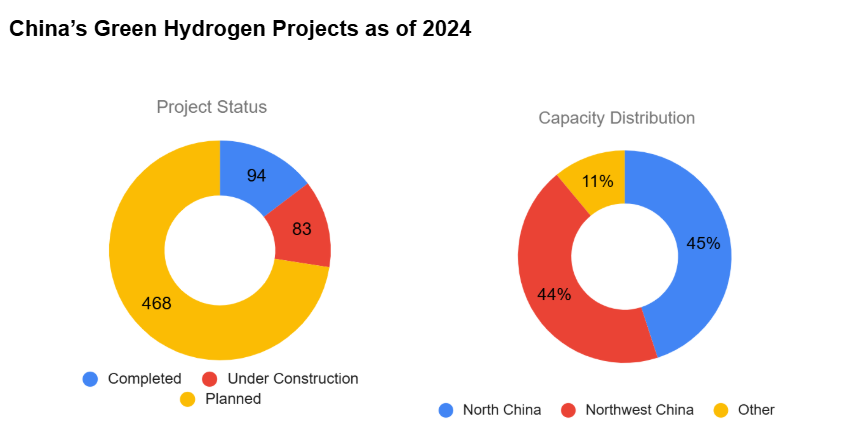

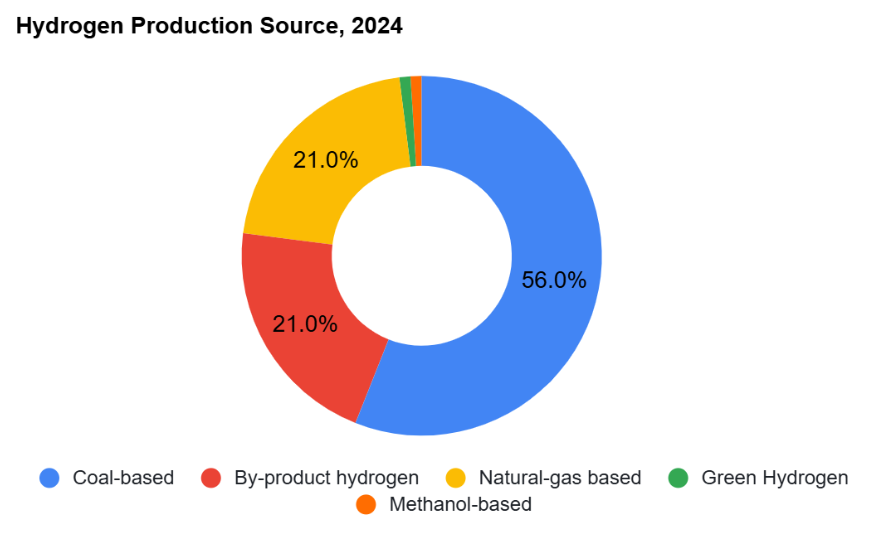

By 2024, China had become the world’s leading hydrogen producer, reaching an annual production of 36.5 million metric tonnes (mt).3 While green hydrogen accounted for only 125,000 mt of the total annual hydrogen production in China, the country accounted for nearly half of the global output. Low-carbon or green hydrogen can significantly contribute to reduction in carbon and energy intensity levels by replacing fossil fuels across various sectors. However, the production methods, and infrastructure for storage and distribution are crucial to enabling the rapid adoption of hydrogen energy in an economy. Several green hydrogen demonstration projects are underway in China—covering production, storage, and application—and are aimed at assessing their technological and commercial viabilities.

This explainer examines China’s policy drive to accelerate the development of green hydrogen, a technology seen as critical to decarbonisation. It discusses provincial action plans shaped by national strategies. These plans enable regions to leverage their respective strengths in the use and production of hydrogen. It also explores China’s growing role in electrolyser manufacturing, and the cost advantages offered by Chinese manufacturers. By combining subsidies, infrastructure development, and industrial clustering, China is lowering the costs of both hydrogen production and equipment—positioning itself as the desired hydrogen supply partner. The analysis also highlights the challenges that China faces in storage, transport, and limited demand, which could constrain domestic adoption. Together, these dynamics shape China’s potential to dominate the emerging global hydrogen economy.

2. Global Green Hydrogen Economy: Supported by Government Policies

Hydrogen has been mainly used in the oil refining industry and as a feedstock for producing chemicals like ammonia and methanol. However, most of the hydrogen presently used in these sectors is produced using fossil fuels. Despite currently low levels of adoption, green hydrogen has the potential to reduce emissions from such hard-to-abate sectors, as well as in the transport and power sectors. Several countries, including Japan, Korea, and the European Union, have introduced policies to support the development of the green hydrogen industry. While the demand for hydrogen has gradually increased between 2020-2025, the year 2024 witnessed a decline in this momentum.4 Offtake agreements for hydrogen globally represented a total volume of 6 million tonnes by the end of 2024, out of which only 1.7 million tonnes were added in the year 2024 as compared to 2.4 million tonnes in 2023. This may indicate a slowing demand from industries for hydrogen. In the case of low-emissions hydrogen, demand increased by 10% but the use only represents 1% of the total hydrogen demand. This could be attributed to challenges with project development, and higher costs associated with green hydrogen production.

Interestingly, Europe accounts for approximately half of the offtake agreements for hydrogen globally, directed towards chemical, refining, and steel industries.5 Japan’s offtake agreements for hydrogen, on the other hand, representing a share of 8%, are focused on the power sector. Increased adoption of green hydrogen by industries requires policy support. This is crucial until technology and supporting infrastructure advance to bring down costs. China’s Hydrogen sector stands out in this context, witnessing continued investment and state support in the form of incentives for both production and applications of green hydrogen. In 2024, methanol and ammonia production consumed between 9.5 to 9.95 million tonnes of hydrogen in China, whereas 6 million tonnes of hydrogen was consumed by the refining sector.6 By 2030, demand for green hydrogen—specifically in China—is expected to rise significantly.7 The chemicals sector is projected to consume around 3.76 million tonnes of green hydrogen, while the metallurgy sector is expected to consume approximately 940,000 tonnes. In transportation alone, green hydrogen demand is expected to reach 3.01 million tonnes, with the Chinese government increasingly pushing for fuel cell vehicles and refuelling infrastructure.

In terms of private sector investment in China, approximately $1.4-1.7 billion was directed towards the green hydrogen industry in 2024. Within the 85 hydrogen-related deals in the year, the electrolyser manufacturing sector benefited the most through primary-market funding, such as Initial Public Offerings (IPOs).8 Besides that, subsidies have been rolled out under both central and local plans to support the development of the industry. A total of over $12 Billion was allocated to promote green hydrogen projects in China through government subsidies by the end of 2024.9 The subsidies are targeted across the chain, from hydrogen production to applications. The Ministry of Finance, for instance, allocated 1.625 billion yuan (about $226 million) to subsidise fuel cell vehicles benefiting ten provinces and cities.10 This, in turn, will create a market for hydrogen. Cities and provinces have introduced their own support measures, such as Dalian and Sichuan—each subsidising up to 20 million Yuan (~$2.8 million) per project. Wuhan issued an action plan for the development of the hydrogen energy industry in September, 2025—focused on developing key technologies, such as the Proton Exchange Membrane (PEM) electrolysers and high-pressure hydrogen storage.11 Under this plan, innovation centres will be established that receive 10 million yuan (~ $1.4 million) in support. In addition to national-level policies, the National Development and Reform Commission (NDRC) has announced a 20% subsidy for setting up green methanol production plants.12 A new list of 41 green hydrogen projects has been announced by the National Energy Administration (NEA) to receive state support in the form of preferential loans and subsidies, as well as nine regional pilot projects that will focus on specific technologies.13

Global demand for hydrogen varies across its application sectors. For oil refining, the demand is concentrated in North America, and there has been a slower adoption of hydrogen in the sector. A majority of hydrogen used in refining is either by-product hydrogen, or hydrogen produced using fossil fuels without carbon capture. Low-emissions hydrogen production and green hydrogen is mainly used by the industry for producing ammonia, methanol, direct reduced iron and green steel. Even in the industrial sector, the current share of green hydrogen is significantly low. Low-emissions hydrogen production in industrial plants in 2024 was about 320 kt, 85% of which was from fossil fuels with Carbon Capture, Utilization, and Storage (CCUS). However, most of the capacity added in 2024 for hydrogen production in the industrial plants relied on water electrolysis. Increasing deployment of electrolysers, and a reduction in production cost is likely to further this demand for green hydrogen in the industrial sector. A major contributing factor for a potential uptake in the industrial demand could be the implementation of mechanisms for carbon credits and carbon leakage prevention, which favor industrial products with reduced carbon footprint during production. Advancements in efficient storage and transportation of hydrogen are also likely to bring down the barriers to the adoption of green hydrogen across sectors. Demonstration projects, therefore, are given significance in current Chinese policies to test the viability of such technologies.

3. National and Provincial Policies in China

The guiding policy for green hydrogen in China is the ‘Medium and Long Term Development Plan for the Hydrogen Energy Industry (2021-2035)’, released by the National Development and Reform Commission-affiliated NEA in 2022.14 This plan sets targets for the adoption of hydrogen energy for the years 2025, 2030, and 2035. The green hydrogen production target for 2025 was set at 100,000-200,000 tonnes. Nearly all provinces in China have rolled out hydrogen energy development plans in line with the Medium and Long Term Plan. Key areas in provincial plans include the establishment of production facilities, building transportation pipelines, and refuelling stations for Hydrogen Fuel cell vehicles.

A recent change in regulation classifies hydrogen as an energy resource in the 2025 Energy Law, thereby exempting it from the regulations and licensing requirements that apply to production, storage, and transportation of hazardous chemicals.15 This would make deployment of necessary infrastructure faster, and allow treating hydrogen like other fuels in energy planning. With the inclusion of hydrogen as an energy resource, the required infrastructure can now be located outside of designated chemical parks.

Table 1: Medium and Long Term Development Plan for the Hydrogen Energy Industry

| Year | Goals |

|---|---|

| 2025 | Basic supply chain • Core tech mastered • Policy & regulation set • ~50,000 FCVs • Initial Hydrogen stations • 100k–200k tonnes renewable Hydrogen• CO₂ cut 1–2 Mt |

| 2030 | Full tech innovation system • Strong Hydrogen supply chains • Broad use in energy, transport, industry • Supports carbon peak |

| 2035 | Integrated Hydrogen ecosystem (transport, power, storage, industry) • Major share of end-use energy |

| Area | Key Tasks |

|---|---|

| Innovation | R&D in fuel cells, electrolysers, storage • Pilot projects • Labs & IP centers |

| Infrastructure | Hydrogen production bases as per local resources • Storage/transport (gas, liquid, pipelines) • Refueling network |

| Applications | Transport (heavy FCVs, buses, ships, aviation) • Storage (wind/solar + Hydrogen) • Power (CHP, backup) • Industry (steel, ammonia, refining |

| Policy & Standards | Establish safety & quality standards • Digital risk monitoring |

| Implementation | “1+N” policy system • Funding & tax incentives • Public awareness • Progress tracking |

3.1. Utilising the Varied Strengths of Provinces

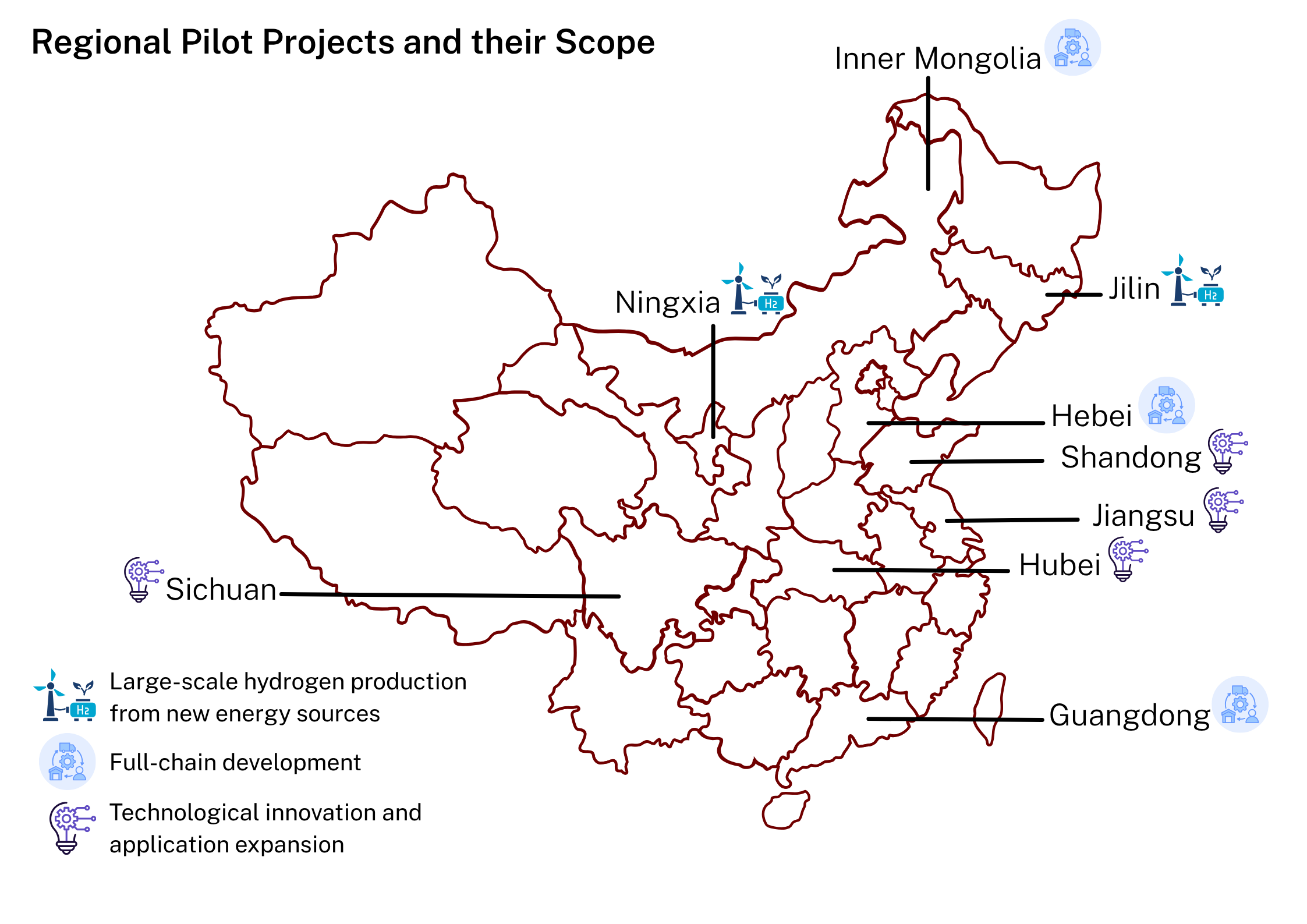

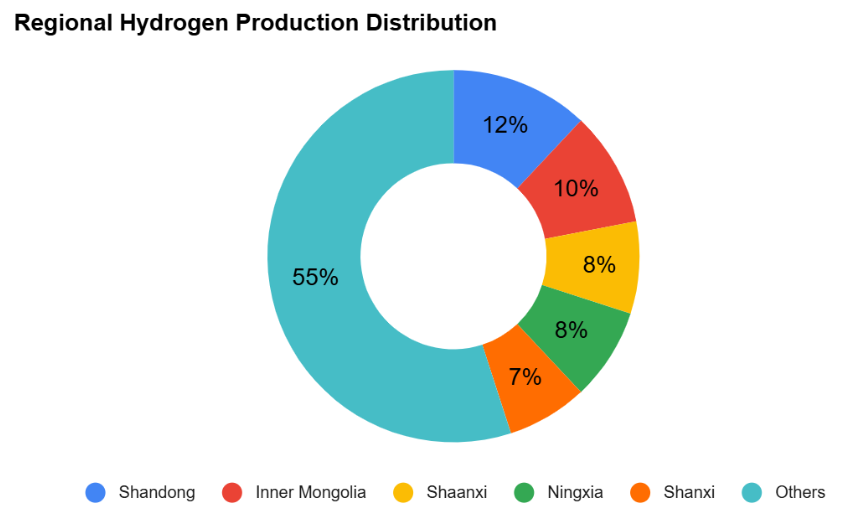

The Medium and Long Term Development Plan sets production targets for low-carbon hydrogen, and encourages R&D collaboration between large, medium, and small enterprises for technological innovation in the industry. It does this in addition to directing the provincial governments to advance hydrogen infrastructure construction, respective to their strengths, in different sectors.16 For instance, provinces such as Inner Mongolia—with higher renewable energy capacity—focus on integrating green hydrogen production facilities, with hydrogen’s additional use case as input for the production of clean fuels. Provinces with a higher concentration of industries, such as Hebei, focus on the adoption of hydrogen to decarbonise industrial production.

Chinese policy approaches for green hydrogen range from incentives to set up hydrogen production plants, to researching the use of advanced technologies like Solid Oxide and Anion Exchange Membrane in production, and building infrastructure for efficient storage and transportation of hydrogen. There is also an increasing focus on hydrogen fuel cell vehicles and refuelling infrastructure. In 2015, the Ministry of Finance announced a gradual reduction in the subsidies for purchasing Battery Electric Vehicles, which were completely withdrawn by the end of 2022.17 In 2019, the ministry also directed local governments to discontinue purchase subsidies for new energy vehicles, except for new energy buses and Fuel Cell Vehicles (FCV).18 A total of $700 million has been allocated towards developing demonstration projects to build and commercialise FCV technologies. This includes deploying FCVs such as buses and commercial freight trucks, and refuelling stations along major routes to demonstrate the viability of hydrogen FCVs for sustainable logistics.

3.2. Provincial Pathways to Green Hydrogen Adoption:

Inner Mongolia is one of the leading provinces in hydrogen production, and has a significant industrial base that could utilise hydrogen to decarbonise production.19 The provincial government issued a ‘Notice on Further Accelerating the High-Quality Development of the Hydrogen Energy Industry’ in 2024.20 Inner Mongolia has a large unused potential of renewable energy, which the province plans to build on. The province added 41GW to its renewable energy capacity in 2024, and plans to add another 40GW in 2025 by building large-scale, integrated wind and solar projects.21 Notably, the policy restricts the sale of electricity generated by wind and solar projects to the grid at 20% of their capacity. The remaining 80% of the power generated must be used for hydrogen production within the province.22 Moreover, Inner Mongolia’s proximity to the Beijing-Tianjin-Hebei cluster makes it well-positioned to supply hydrogen to the industrial cluster. Interprovincial pipelines that can help the producers export green hydrogen to other industrial hubs are also being planned.23 The demonstration project of the hydrogen transmission pipeline from Ulanqab City, Inner Mongolia to the Beijing-Tianjin-Hebei region is being built to prove feasibility.

One of the demonstration cities is Zhangjiakou in Hebei province, which was also selected to co-host the low-carbon 2022 Winter Olympic Games owing to its high renewable energy capacity. Zhangjiakou is a major contributor to the province’s installed capacity of wind and solar power, which places it in a stronger position to divert the excess wind and solar energy to produce green hydrogen. Zhangjiakou has been designated as a hydrogen industry cluster within Hebei province, benefiting from direct subsidies and tax incentives allocated for technology companies operating in this sector.24 A 1,037.82 km-long inter-regional hydrogen pipeline is also under construction—from Zhongjiakou to Tangshan city. Feasibility in such transportation of hydrogen can support the use of low-carbon fuel in carbon-intensive industries, such as iron and steel.25

Source: National Energy Administration

Source: National Energy Administration

Similarly, Chengdu city in Sichuan province provided subsidies for companies specialising in hydrogen storage, manufacturing key parts and components for the industry, refuelling stations, and projects experimenting with hydrogen mixing and pipeline network construction.26 However, demonstration projects show that costs for producing and transporting hydrogen remain a challenge for FCV adoption. While provinces have aligned with the national goal of increasing green hydrogen production, a recurring problem across their policies is the inadequate attention to the limited demand for hydrogen energy solutions—including FCVs and as feedstock in industries.

Shandong province was one of the first to roll out a hydrogen energy development program and has achieved significant progress through its ‘Hydrogen For All’ project. It was also focused on demonstrating the viability of hydrogen ports and corridors, as well as blending hydrogen with natural gas. It has also developed a microgrid technology wherein hydrogen is produced using solar energy generated onsite through PEM electrolysers, which is then stored and used to produce heat and electricity. This demonstrated a system that closely couples hydrogen production and consumption.

In 2024, renewable hydrogen production projects added a total capacity of 493.4 MW in China. Alkaline water electrolysis (ALK) remained the prevalent technology, with the majority of plants powered by solar energy.27

Source: China Hydrogen Development Report 2025

Source: China Hydrogen Development Report 2025

Source: China Hydrogen Development Report 2025, translated using GoogleTranslate

Source: China Hydrogen Development Report 2025, translated using GoogleTranslate

4. Electrolyser Manufacturing Capacity in China

On the technology front, electrolysers are key to green hydrogen production. Green hydrogen production uses water as the input or feedstock, which is then split into hydrogen and oxygen using electrolysers powered by renewable electricity. There are mainly two types that are currently used in commercial production—ALK and PEM electrolyser. The 14th Five-Year Plan of Energy Technology Innovation (2021) aimed to enhance technological capabilities for producing PEM and Solid Oxide (SO) electrolysers.28,29 A study of patents related to hydrogen production from 2013-2022 reveals that China is a frontrunner in hydrogen patent publications, with Huaneng Group being the top assignee.30

Alkaline electrolysers are a mature technology for hydrogen production and come with lower initial costs. In 2024, the average system price of ALK electrolysers in China was 1400 yuan/kW (~$196/kW), and that of PEM electrolysers was 6300 yuan/kW (~$885/kW).31 As of December 2024, approximately 80% of green hydrogen production plants in China employed alkaline water electrolysis.32 ALK electrolysers are also widely used due to China’s cost advantages in producing these electrolysers. Even when exported to other countries, utilising ALK electrolysers can offer up to 45% of cost advantages to hydrogen production plants. Similar to the case of Solar PhotoVoltaic modules, China has come to dominate nearly 85% of the global manufacturing capacity of ALK electrolysers.33

ALK electrolysers, while a mature and cost-effective technology for hydrogen production, are less efficient when integrated with RE sources. As RE sources like solar and wind power inherently produce variable outputs—depending on varying solar irradiance and wind speeds—the electrical input from these sources fluctuates, leading to a reduction in the overall efficiency of the hydrogen production process. PEM electrolysers, on the other hand, are flexible to fluctuating loads and offer higher purity hydrogen as output, which is suitable for industrial use.

Table 2: Major Electrolyser Manufacturers and Hydrogen Producers in China

| Company | Entity Type | |

| 1 | Sungrow Hydrogen | Privately owned |

| 2 | Wuxi Huaguang | State owned |

| 3 | Guangdong Shengqing | Privately owned, Sunfly new energy |

| 4 | Trina Solar Hydrogen | Privately owned |

| 5 | Beijing Power Equipment Group | State owned |

| 6 | Tianjin Mainland Hydrogen | Privately owned |

| 7 | Shanghai Electric | State owned |

| 8 | Cockerill Jingli Hydrogen | JV between John Cockerill and Suzhou Jingli |

| 9 | Shuangliang Group | Privately owned |

| 10 | PERIC | State owned |

| 11 | Longi Hydrogen | Public |

| 12 | BriHyNergy | Privately owned, Started as an R&D project |

| 13 | SPIC Hydrogen | State owned |

| 14 | Enze (Guangdong) Hydrogen Energy Co., Ltd. | State owned, Previously a JV with an American Company |

| 15 | Sinopec | State owned |

| 16 | Envision | Privately owned |

| 17 | China Huadian Corporation (CHC) | State owned |

| 18 | Ningxia Baofeng Energy Group | Privately owned |

| 19 | China Longyuan Power Group (CHN Energy) | State owned |

| 20 | State Power Investment Corporation | State owned |

Low-cost equipment, coupled with the large potential of renewable energy, allows certain provinces to supply green hydrogen below global average prices.34, [35] Xinjiang and Henan provinces, for instance, supply green hydrogen at the price of $2.24/kg as of August 2025 against the global average of $4-5/kg. Similarly, Inner Mongolia has a large RE potential, and will be able to provide cheaper green hydrogen as and when plants are commissioned. Furthermore, prices will also be decided on the transportation costs of green hydrogen. As China successfully builds transportation pipelines between hydrogen production hubs and industrial clusters, green hydrogen costs will be reduced owing to larger volumes, and fewer operations and handling costs. Lastly, established companies, specialising in renewable energy equipment, shall have a greater advantage in venturing into green hydrogen production. For instance, Envision Energy recently commissioned the largest green hydrogen and green ammonia plant powered by off-grid renewable energy in Chifeng, Inner Mongolia. Additionally, SOEs already operating in the power generation industry and equipment manufacturing have significantly invested in hydrogen production, as well as electrolyser manufacturing facilities.

5. Conclusion

China is rapidly scaling up its green hydrogen production. Applying the same strategy of building massive production capacity through subsidies and tax incentives as it did in electric vehicles, China seems set to dominate yet another green energy sector. Currently, policies for the green hydrogen industry focus on increasing domestic adoption, testing technologies and demonstrating commercial viability. In green hydrogen, the challenge lies in transporting it and facing an initially low demand from industry. While the guiding policies also mention increasing the use of green hydrogen for refining and metallurgy, the emphasis in demonstration projects has largely been on the transportation sector and green ammonia or methanol production.

The importance of green hydrogen is in enabling countries to decarbonise their industrial production, and meet their net-zero targets. Nations are also looking towards green hydrogen to enhance their energy security. In that case, China’s role as an electrolyser supplier could also place it in a pivotal position in a new energy future. China already dominates the space of low-cost, low-efficiency ALK electrolyser manufacturing. However, other countries in Europe and North America have already set up manufacturing facilities for both ALK and PEM electrolysers. India is also emerging as a significant supplier of electrolysers.35 Domestic capacities and caution from countries might prevent China from capturing the markets, like it did with Solar PV modules.

China’s ambitious push toward the adoption of green hydrogen is also a crucial step in addressing its global image as the leading carbon emitter. The integration of green hydrogen across various sectors of the Chinese economy is poised to mitigate this reputation. While domestic demand for hydrogen currently lags behind the projected supply from announced production projects, China undeniably plays a pivotal role in the global hydrogen landscape—accounting for a substantial one-third of the world’s total hydrogen demand.36 This significant share underscores China’s potential to drive the global adoption of green hydrogen technologies. The development of a robust green hydrogen infrastructure within China will not only contribute to its own decarbonisation goals, but also help set standards and processes for other nations aiming to increase their adoption of green hydrogen. China’s scale and industrial capacity could accelerate the cost reduction and technological advancements necessary for green hydrogen to become a viable and widely accessible energy source on a global scale. Moreover, its applications as a clean fuel across various energy-intensive sectors necessitate significant attention by policymakers. Should green hydrogen adoption become widespread, a concentration of supply chain in China would culminate into situations similar to dependencies in critical minerals.

Annexure

List of Demonstration Projects as announced by the National Development and Reform Commission.

| Second batch of projects announced in April, 2025 |

| No | Project | Scope | Location | Implementing Body | Project Focus |

|---|---|---|---|---|---|

| 1 | 100,000-ton green biomethanol production demonstration project | Process Carbon Reduction | Gansu | Haijin (Zhangye) Biofuel Co., Ltd. | End-use application |

| 2 | Megawatt-class long-cycle photovoltaic-liquid hydrogen coupled integrated energy utilisation demonstration project | Carbon reduction at the source | Guangdong | Zhongshan Advanced Cryogenic Technology Research Institute | Production + Storage |

| 3 | Electricity-hydrogen-ammonia integrated microgrid comprehensive energy demonstration project | Carbon reduction at the source | Guangdong | Foshan Xianhu Laboratory | Production + Storage + Application + Transportation |

| 4 | Zero-carbon high-grade thin steel plate factory demonstration project | Process Carbon Reduction | Guangdong | Baosteel Zhanjiang Iron and Steel Co., Ltd. | Application |

| 5 | Demonstration project for producing green hydrogen and high-purity carbon dioxide from domestic waste | Process Carbon Reduction | Guangdong | Zhongpeng Future (Guangdong Nanhai) Technology Co., Ltd. | Production + Carbon Capture |

| 6 | Grid-type wind, solar and storage active support and aggregation network demonstration project | Carbon reduction at the source | Hebei | State Grid Jibei Electric Power Co., Ltd. | Production + Storage |

| 7 | Flexible wind-solar hydrogen storage and ammonia-alcohol integrated demonstration project | Carbon reduction at the source | Heilongjiang | Anda Tianying New Energy Co., Ltd. | Production + Application |

| 8 | 100,000-ton wind-solar hydrogen production integration and hydrogen transmission pipeline project from Ulanqab to the Beijing-Tianjin-Hebei region demonstration project | Carbon reduction at the source | Inner Mongolia | Sinopec New Star (Inner Mongolia) West-East Hydrogen Delivery New Energy Co., Ltd. | Production + Storage + Transportation |

| 9 | 2 million kilowatts of wind power to produce green hydrogen and 500,000 tonnes of green methanol demonstration project | Carbon reduction at the source | Inner Mongolia | Goldwind Green Energy Chemical (Xing’an League) Co., Ltd. | Production + Application |

| 10 | Green hydrogen energy key equipment testing and verification-based demonstration project | Carbon reduction at the source | Inner Mongolia | China National Energy Group Hydrogen Energy Technology Co., Ltd. | Production + Storage + Application (Testing) |

| 11 | Green Hydrogen Production, Storage and Utilisation Integrated Demonstration Project (Phase I) | Carbon reduction at the source | Jiangsu | Yancheng Jidian Hydrogen Energy Technology Co., Ltd. | Integrated Production and Utilisation |

| 12 | 12,000-ton green hydrogen production, storage, transmission and utilisation integrated demonstration project | Carbon reduction at the source | Ningxia | Ningxia Reshape Hydrogen Energy Technology Co., Ltd. | Production + Storage + Transportation |

| 13 | Ningxia Taiyangshan Hydrogen and Ammonia Valley Integrated Source, Grid, Load, and Storage Project (Phase I) | Carbon reduction at the source | Ningxia | Seraphim Reconstruction (Ningxia) Hydrogen Energy Co., Ltd. | Production + Storage |

| 14 | Green hydrogen equipment and fuel cell technology demonstration base demonstration project | Carbon reduction at the source | Tianjin | China Automotive Research Institute New Energy Vehicle Inspection Center (Tianjin) Co., Ltd. | Production + Storage |

| 15 | 600,000 tonnes of carbon dioxide recovery and production of green organic slow-release fertiliser demonstration project | Terminal carbon sequestration | Xinjiang | Xinjiang Tiankelong Chemical Co., Ltd. | Production + Application |

| First batch of projects announced in April, 2024 |

| No | Project | Scope | Location | Implementing Body | Project Focus |

|---|---|---|---|---|---|

| 1 | Demonstration project of a complete set of technologies for clean and efficient combustion of coal-fired boilers using ammonia with an integrated photovoltaic hydrogen-ammonia production platform | Carbon reduction at the source | Anhui | Wanneng Tongling Power Generation Co., Ltd. | Production + Application |

| 2 | Zhangjiakou wind-hydrogen integrated source-grid-load-storage demonstration project (phase i) | Carbon reduction at the source | Hebei | Hebei Guochuang Hydrogen Energy Technology Co., Ltd. | Production + Application |

| 3 | A demonstration project of the innovative “electricity-hydrogen-electricity” model based on pure hydrogen gas turbines | Carbon reduction at the source | Inner Mongolia | State Power Investment Corporation Beijing Chongran Energy Technology Development Co., Ltd., Inner Mongolia Huomei Hongjun Aluminum and Electricity Co., Ltd. | Production + Application |

| 4 | 500,000-kilowatt wind power hydrogen and ammonia integrated demonstration project | Carbon reduction at the source | Inner Mongolia | China Shipbuilding Industry Corporation Wind Power Development Co., Ltd. | Production + Storage + Application |

| 5 | Hydrogen energy industrial park (green hydrogen ammonia alcohol integration) demonstration project | Carbon reduction at the source | Jilin | Nengjian Green Hydrogen and Ammonia New Energy (Songyuan) Co., Ltd. | Production + Application |

| 6 | High-parameter liquid hydrogen storage and transportation equipment project | Carbon reduction at the source | Jiangsu | Aerospace Morning Light Co., Ltd. | Storage + Transportation |

| 7 | Key technology research and development and engineering demonstration project for long-process all-oxygen, hydrogen-rich, low-carbon ironmaking | Process Carbon Reduction | Hebei | Hesteel Group Co., Ltd. | Application |

| 8 | 2500m3 Hydrogen-rich carbon recycled oxygen blast furnace (hyc rof) commercial demonstration project | Process Carbon Reduction | Xinjiang | Baosteel Group Xinjiang Bayi Iron and Steel Co., Ltd. | Application |

Footnotes

Ministry of Ecology and Environment. “China’s Policies and Actions for Addressing Climate Change” Ministry of Ecology and Environment of the People’s Republic of China, 2022.↩︎

Climate Analytics and NewClimate Institute . “Climate Action Tracker-China” Climate Action Tracker, 2025.↩︎

Yin, Ivy. “China Has Established 125,000 MT/Year of Green Hydrogen Production Capacity: NEA.” S&P Global Commodity Insights, April 30, 2025.↩︎

IEA. “Global Hydrogen Review 2025.” IEA, September 2025.↩︎

Ibid.↩︎

National Energy Administration. “China Hydrogen Energy Development Report (2025).” National Energy Administration, April 2025.↩︎

Li, Ting, Wei Liu, Yanming Wan, and Zhe Wang. “China’s Green Hydrogen New Era.” RMI, September 2022.↩︎

Yuki. “China Hydrogen Investment Review 2024.” Energy Iceberg, June 12, 2025.↩︎

L, Jennifer. “U.S. Green Hydrogen Cuts Give China an Edge in the Clean Energy Race.” Carbon Credits, October 13, 2025.↩︎

“24省市33条! 2024年11月氢能政策汇总! [33 Policies from 24 Provinces and Municipalities! A Summary of Hydrogen Energy Policies in November 2024!].” IHEE Hydrogen Energy Industry Exhibition. Accessed November 14, 2025.↩︎

“SMM Hydrogen Policy Update Wuhan Municipal People’s Government: Three-Year Action Plan for Hydrogen Energy Industry Development (2025–2027) Notice.” Shanghai Metal Market, October 14, 2025.↩︎

Zhang, Chongyang. “China Announces 20% Investment Subsidy for Green Methanol Production Projects.” hydrogeninsight.com, October 23, 2025.↩︎

Zhang, Chongyang. “China Promises Government Support to 41 Clean-Hydrogen Projects.” hydrogeninsight.com, 2025.↩︎

“氢能产业发展中长期规划(2021-2035 年) [Medium and Long Term Development Plan for the Hydrogen Energy Industry (2021-2035)].” National Development and Reform Commission, March 2022.↩︎

“China Releases Its First Energy Law.” Climate Cooperation China, January 23, 2025.↩︎

“China’s Hydrogen Industry Enters New Stage of Orderly Development.” Fuel Cells Works, June 4, 2025.↩︎

Yu, Bai. “Life after Subsidies for China’s EVs.” Dialogue Earth, December 13, 2023.↩︎

Ministry of Finance, Ministry of Industry and Information Technology, Ministry of Science and Technology, and National Development and Reform Commission. 关于进一步完善新能源汽车推广应用财政补贴政策的通知 财建〔2019〕138号 [Notice on Further Improving the Fiscal Subsidy Policy for the Promotion and Application of New Energy Vehicles (Finance and Construction Document No. 138 [2019])], March 2019.↩︎

Lou, Yushan, and Anne-Sophie Corbeau. “China’s Hydrogen Strategy: National VS. Regional Plans” Center on Global Energy Policy at Columbia University SIPA , October 2023.↩︎

International Energy Network. “内蒙古:并网型风光制氢项目年上网电量不超20%! [Inner Mongolia: Grid-Connected Wind and Solar Hydrogen Production Projects Will Not Generate More than 20% of Their Annual Electricity on the Grid!].” International Energy Network, June 2024.↩︎

“Inner Mongolia Adds over 41 GW of New Renewable Energy Capacity in 2024.” Inner Mongolia Autonomous Region, January 2025.↩︎

International Energy Network. “内蒙古:并网型风光制氢项目年上网电量不超20%! [Inner Mongolia: Grid-Connected Wind and Solar Hydrogen Production Projects Will Not Generate More than 20% of Their Annual Electricity on the Grid!].” International Energy Network, June 2024.↩︎

“全国首条跨省绿氢管道内蒙古段获批 [The Inner Mongolia Section of the Nation’s First Inter-Provincial Green Hydrogen Pipeline Has Been Approved.].” People’s Government of Inner Mongolia Autonomous Region, July 2025.↩︎

Miller-Wang, Arabella. “China’s Hydrogen Development: A Tale of Three Cities.” Oxford Institute for Energy Studies, March 2023.↩︎

Wu, Jian. “1037 Km-China’s Longest Pure Hydrogen Pipeline Will Start Construction Soon.” China Hydrogen Bulletin, December 17, 2024.↩︎

Miller-Wang, Arabella. “China’s Hydrogen Development: A Tale of Three Cities.” Oxford Institute for Energy Studies, March 2023.↩︎

China Hydrogen Alliance. “China Hydrogen Alliance:2024 Annual Report on the Development of China’s Hydrogen Energy Industry.” Fuelcell China, January 2024.↩︎

National Energy Administration and Ministry of Science and Technology. “关于印发《’十四五’能源领域科技创新规划》的通知 国能发科技〔2021〕58号 [Notice on Issuing the ‘14th Five-Year Plan for Science and Technology Innovation in the Energy Sector’ (Guonengfa Keji [2021] No. 58)].” Energy Bureau, November 29, 2021.↩︎

Gong, Xiaohan. “Hydrogen in China: Why China’s Success in Solar PV Might Not Translate to Electrolyzers.” Oxford Institute for Energy Studies, February 2025.↩︎

Arsad, S.R., Pin Jern Ker, M.A. Hannan, Shirley G.H. Tang, Norhasyima R S, C.F. Chau, and T.M.I. Mahlia. “Patent Landscape Review of Hydrogen Production Methods: Assessing Technological Updates and Innovations.” International Journal of Hydrogen Energy 50 (January 2024): 447–72.↩︎

Jigong Vogel. “2024年中国电解槽价格数据分析 [Analysis of Electrolytic Cell Price Data in China in 2024].” ner.jgvogel.cn, April 7, 2025.↩︎

Yan, Zhang. “氢能产业观察 [Hydrogen Observation].” China Hydrogen Alliance Research Institute, February 2025.↩︎

Zhao, Tiantian, and Bridget van Dorsten. “The Competitive Edge of China’s Electrolysers.” Wood Mackenzie, September 5, 2024.↩︎

“Xinjiang Green Hydrogen Price, USD/Nm3.” SMM Information & Technology, 2025.↩︎

IEA. “Global Hydrogen Review 2025.” IEA, September 2025.↩︎

IEA. “Global Hydrogen Review 2024.” IEA, October 2024.↩︎