Executive Summary

Anwesha Sen manages the GCPP (Tech and Policy) programme and researches AI governance, data protection, and open technologies.

This paper argues that strategic development of India’s domestic data centre infrastructure is vital to strengthen the country’s position in the global technology supply chain and ensure reliable access to emerging technologies. It finds that India produces approximately 20 percent of the world’s data but maintains only about 1 percent of global data centre capacity as of April 2025. This is a result of critical barriers such as high capital requirements, economies of scale benefiting incumbents, strong network effects, and a shortage of specialised expertise, which collectively limit industry expansion and new entry.

The author would like to express her sincere gratitude to Bharath Reddy, Pranay Kotasthane, and Sridhar Krishna for their valuable feedback and research guidance.

The paper recommends modernising India’s power infrastructure, building targeted sectoral AI data centres, and leveraging multilateral and bilateral partnerships to stimulate market growth and demand. Six key infrastructure components – servers, storage, networking, power, water, and real estate – are examined for market conditions, challenges, and policy gaps. By prioritising capacity-building and policy reforms, India can secure its place within the global technology supply chain, drive job creation and investment, and improve digital resilience.

Introduction

Conversations on Artificial Intelligence (AI) in India often overlook the critical role of data centres in shaping this ecosystem. While building local data centres is not foundational to AI model development itself, it plays an important role with respect to data storage, processing, and training AI models. Moreover, a robust and resilient domestic data centre market carries significant geopolitical and economic importance for India. Despite generating nearly 20 percent of the world’s data, India’s data centre capacity – about 1.2 GW as of April 20251 – accounts for only 1 percent of the total global data centre capacity (114 GW).2 To highlight the disparity in data centre capacity, the average data centre capacity in the US is 20.5 MW, whereas India’s largest data centre is 5 MW.3 Steep entry barriers due to capital intensity, economies of scale, network effects, and technical complexity are some factors contributing to this lack of capacity.

The nascency of data centre development in India is due to three reasons. Data centres require massive upfront investment, as these are large-scale facilities with sophisticated hardware, secure networking, and reliable power and cooling systems. As a result, economies of scale heavily favour established players: larger data centres can distribute operating costs more efficiently, offering cheaper services per unit of computation or storage, which smaller players struggle to match. Network effects amplify concentration, as customers prefer providers with global reach and integrated platforms, creating a cycle that further entrenches incumbents. In addition, the ecosystem demands highly specialised technical expertise in areas like energy management, thermal engineering, and cybersecurity.

Lastly, there is a lack of local demand for data centres in India. While regulatory demands from the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), telecom authorities, and the Digital Personal Data Protection Act (DPDPA) necessitate local data storage for sensitive sectors such as banking, healthcare, and national security, other data produced in India is largely stored and processed in facilities abroad.

For India, the strategic development of domestic data centres and their associated infrastructure is a geopolitical imperative. In the context of rapidly shifting geopolitical dynamics, domestic data centres provide a critical safeguard for ensuring reliable access to emerging technologies, and strengthen India’s position in the global AI supply chain. Furthermore, building this infrastructure generates a range of domestic benefits such as driving innovation, creating high-quality jobs, and attracting both foreign and domestic investment.

This paper examines six critical components of data centre infrastructure – servers, storage systems, networking equipment, power, water, and real estate – and provides an overview of the current market conditions, challenges, and existing policy frameworks for each. The paper then recommends strategies for modernising India’s power infrastructure and growing the data centre market in India by emphasising strategic multilateral and bilateral partnerships to increase demand, alongside adopting a sectoral approach to developing AI data centres where necessary, rather than merely expanding data centre capacity.

AI Use Declaration

Analysis for this paper was done with the help of Perplexity to identify relevant resources. Some paragraphs have been copy-edited using Perplexity.

Standardisation

To ensure consistency in analysis throughout this paper, the following standardisations have been made:

Current and projected data centre capacity: A data centre’s capacity is measured in terms of the total power required by the data centre to function. This provides a standard unit of measurement, whereas other factors such as server count or processing power cannot be standardised. India’s current data centre (DC) capacity is estimated at 1.2 GW (as of April 2025),4 with a projected increase to 17 GW by 2030,5 as per a Jefferies report. There are other industry and government projections that fall within this range.

Data centre capacity:

- Average data centre capacity is 10 MW in countries such as the US and China.

- Hyperscale data centres have a capacity of 100 MW. Note: The largest data centre in India as of June 2025 has a 5.845 MW capacity (Yotta Shakti Cloud NM1 Phase 1).

AI chip standard: All GPU-related estimates are standardised using the specifications of NVIDIA’s H100 accelerator, a commonly deployed AI chip in hyperscale data centres.

Chip power consumption: NVIDIA H100 SXM5 chips on average consume at most 700 watts of power.6 These chips are well-suited for intensive AI development and also have comparatively higher power requirements with respect to other similar chips. Using this as the standard for an AI infrastructure strategy will future-proof it while also keeping it realistic.

Chip estimation formula: The number of H100 chips per megawatt (MW) of compute capacity is calculated using the formula,

Number of chips = (0.5 × DC capacity (W))/700W

where 50 percent of total data centre capacity is allocated to compute workloads.7

Land requirement: The land footprint required for a 10 MW facility is about 10 acres (435,600 square feet), which includes space for infrastructure, redundancy, and future expansion.

Water consumption: Annual water consumption is estimated at 25.5 million litres per MW, based on cooling requirements in Indian climatic conditions.8 This is equivalent to the annual water consumption by 500 people (per person per day consumption is 135 litres).9

PUE: Power Usage Effectiveness (PUE) is a metric used to assess how efficiently a data centre uses energy. It is calculated by measuring the ratio of the total energy consumed by the facility to the energy consumed by the IT equipment within it. An annual PUE of 1.610 is assumed for Indian data centres as of 2024, based on prevailing energy efficiency standards. Indian data centres currently have an efficiency ranging from 1.3 to 1.6. The higher end of the range has been taken as standard, to provide a conservative estimate.

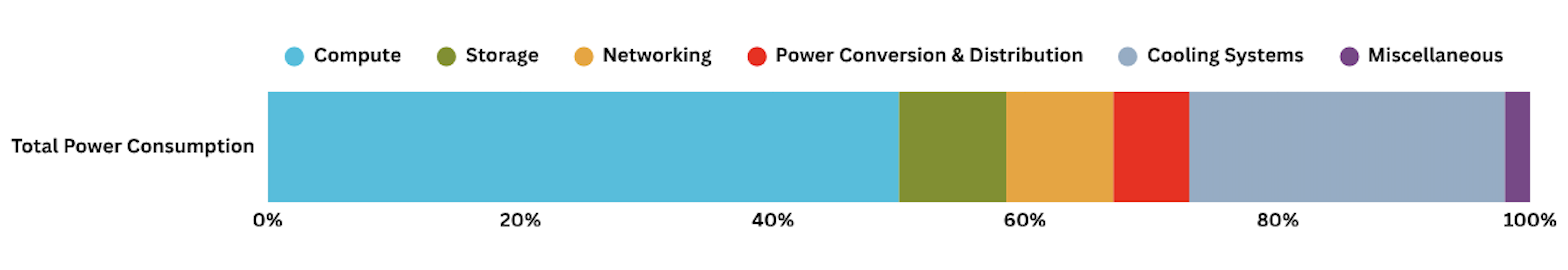

A PUE of 1.6 implies that for every 1 watt of electricity used by IT equipment (compute), 1.6 watts of electricity is consumed by the entire facility. The following break-up is an approximation of how much power is consumed by compute and the other major components in a data centre.11 These components are discussed in later sections of the paper.

| Component | Percentage of Power Consumption (AI-intensive) |

|---|---|

| Compute | 50 percent |

| Storage | 8.50 percent |

| Networking | 8.50 percent |

| Power Conversion & Distribution | 6 percent |

| Miscellaneous | 2 percent |

| Cooling Systems | 25 percent |

Table 1: Power consumption break-up for a data centre in India

Why does India need data centres?

1. Strengthening India’s role in the AI supply chain

For India, the strategic development of domestic data centres and their associated infrastructure is not merely a technological imperative, but a geopolitical necessity. Recent events, such as Microsoft’s suspension of cloud services to Nayara Energy – a major Indian oil refiner with Russian investments12 – highlight the vulnerabilities India faces when critical digital infrastructure and data management depend on foreign-owned platforms subject to geopolitical pressures and sanctions regimes. This incident exposed how unilateral decisions by global technology providers, influenced by international sanctions and geopolitical tensions, can disrupt essential business operations and threaten national security. Against this backdrop, India’s push to build data centres is aligned with broader geopolitical goals to secure reliable access to emerging technologies and strengthen India’s position in the global AI supply chains. The Biden administration’s now-revoked AI diffusion framework emphasised that the future of AI will be shaped not only by innovation but also by strategic control over compute infrastructure and data access.13 Domestic data centres will ensure that India can safeguard national interests, foster indigenous technological and economic growth, and participate more assertively in the geopolitics of emerging AI technologies.

2. Serving as a regional data hub, but not for data localisation

India’s data centre strategy should prioritise establishing itself as a regional digital hub rather than focusing on data localisation mandates. The country’s competitive advantage lies in its low operating costs. In 2025, building a data centre in India averaged just US$7 per watt, which is significantly cheaper than the US (US$10/W) and UK (US$11/W), and nearly matches China (US$6/W).14 This incentivises other countries to invest and set up data centres in India and can lead to rapid growth in both hyperscale and edge data centres, positioning India as a strategic base for regional and international firms servicing Bangladesh, Sri Lanka, Nepal, Southeast Asia, and beyond.

3. Catalysing economic growth

The expansion of data centres would have a multiplier effect on India’s economy. Between 2019 and 2024, the data centre market in India attracted around US$60 billion in investments and grew at a compound annual growth rate (CAGR) of 24 percent.15 The market’s size is projected to grow rapidly in the coming years due to an increase in demand for digital services and it is attracting more foreign direct investment (FDI) and partnerships with global technology firms.16 Data centre investments also generate massive ancillary benefits, such as increasing skilled jobs in IT, engineering, construction, and logistics.

4. Expanding digital connectivity

Incentivising the development of data centres beyond Tier-1 cities will improve digital connectivity and help bridge the digital divide. Tier-2 and Tier-3 locations can act as regional digital hubs, reducing latency and improving the reliability of cloud and digital services across rural and semi-urban areas. This will help bridge India’s persistent digital divide, which limits access to online education, telemedicine, e-governance, and digital employment opportunities in non-urban areas. Inclusive digital infrastructure is critical for accelerating digital access across geographical and socio-economic boundaries.

5. Power infrastructure

Large-scale, AI-ready data centres also intensify the urgency of modernising India’s power infrastructure. Uninterrupted and high-quality power is a non-negotiable demand not only for data centre operations but for all digital-led sectors. However, India still suffers from transmission and distribution (T&D) losses amounting to 16.64 percent in FY2023-2417 – which is more than double the global average of 6-8 percent18 – leading to significant economic wastage and undermining productivity across sectors. Modernising the electricity grid for reliability, capacity, and sustainability will reduce outages and economic losses across sectors while also boosting data centre growth and enabling the deployment of renewable energy solutions for sustainability locally.

Data Centre Components

Data centres are facilities that store, process, and distribute large volumes of digital information, and their operation requires substantial infrastructure and resources. As the backbone of the digital economy, data centres enable a wide range of services such as cloud computing, IT operations, financial systems, and increasingly, the development and deployment of AI applications.

The infrastructure requirements of data centres can be broadly categorised into six key components, encompassing both internal hardware and external support systems.

Servers: Servers are the core computing units within a data centre. These are composed of racks that house semiconductor chips, primarily central processing units (CPUs) and graphics processing units (GPUs). GPUs are critical for training and running large-scale AI models.

Storage Systems: Data storage is managed through High Bandwidth Memory (HBM), hard disk drives (HDDs), and solid-state drives (SSDs), which serve as the primary storage mediums for processing, retrieval, and archival of data.

Networking Equipment: Switches, routers, firewalls, and cabling constitute the network for secure and high-speed data transmission in data centres. This paper primarily examines switches and routers, which play a crucial role in managing traffic and maintaining connectivity.

Power Infrastructure: Continuous and reliable access to electricity is critical for data centres. The primary source of electricity is the main power grid, which utilises a mix of renewable and non-renewable sources of power and is susceptible to disruptions due to factors such as infrastructure failures and extreme weather. Since grid power cannot provide an uninterrupted supply throughout, this necessitates diesel generators and battery-based energy backup systems to ensure continuous operations. Power outages can lead to system malfunctions, data loss, and equipment failure. Data centre power requirements vary widely by size and function, ranging from 50 kW for edge facilities to over 100 MW for hyperscale centres.

Water and Cooling Systems: Effective thermal management is critical, particularly in AI-focused data centres with high compute densities, i.e. the number of servers or amount of computing power installed in each rack in a data centre. A small 1 MW facility may consume up to 25.5 million litres of water annually,19 while 100 MW hyperscale centres can consume up to 730 million litres annually.20

Real Estate: A 10 MW facility requires about 10 acres (435,600 square feet) of flat, industrial or commercially zoned land, preferably in temperate regions to reduce cooling demands.21 Proximity to power infrastructure, fibre optic connectivity, and water sources is also essential for efficient operation.

The following section provides an overview of the market and government interventions for each of the above components. This is aimed at understanding where India stands in terms of infrastructure preparedness to develop local data centre capabilities.

Data Centres: An Industry Overview

India’s data centre market is attracting significant investments due to rapid digitisation across the country, an increase in AI adoption, and data localisation mandates like the RBI’s directives and the DPDPA. However, this industry is dominated by global hyperscalers, with AWS, Microsoft Azure, and Google Cloud Platform collectively accounting for 87 percent of the Infrastructure-as-a-Service (IaaS) cloud market.22 The remaining share comprises regional providers, enterprise-run facilities, and specialised niche offerings. This market concentration highlights the scale advantages and network effects enjoyed by leading cloud operators which, in turn, reinforce barriers to entry for newcomers.

As per the nature of the market, existing players benefit from strong customer lock-in, tight integration with complementary services, and established network effects, all of which make it costly and complex for customers to switch providers. A new data centre entrant is unlikely to compete meaningfully with hyperscalers in large-scale general-purpose cloud or colocation services (third-party data centres where businesses can rent space to house their own servers). Instead, viable opportunities may exist in focusing on niche or edge use cases, such as ultra-low latency applications or highly specialised workloads (which require bespoke solutions that are not addressed by the larger players). The development of edge or smaller data centres can create defensible market positions that are partly protected from hyperscaler dominance.

It is also important to note that the overall market statistics often do not account for the substantial data centres owned by companies such as Meta23 or OpenAI24 globally, which are developing large dedicated facilities for internal use rather than as commercial resources. While a handful of domestic firms and larger IT companies in India could theoretically also invest in their own data centre infrastructure, this has yet to become a significant trend. The primary reason appears to be less about data centre constraints and more about insufficient demand, the lack of market maturity, and the lack of investment in R&D among Indian firms.

Thus, India’s relatively low data centre capacity is primarily a reflection of insufficient domestic demand, as most firms continue to rely on global cloud platforms, leaving little incentive for large-scale indigenous investment. Secondly, the limited presence of domestic data centre players is further constrained by the structural challenges of economies of scale, entrenched network effects, and high capital intensity.

In terms of data centre policies, Maharashtra, Karnataka, Tamil Nadu, Uttar Pradesh, and West Bengal have state policies incentivising the establishment of data centres. These policies provide subsidies and exemptions from tariffs, duties, and inspections (such as those pertaining to maternity benefits, contract labour, payment of wages, equal remuneration, Employees Provident Fund, and minimum wages). Moreover, the policies aim to guarantee continuous access to electricity and water, minimise zoning restrictions, and provide single-window clearances required to set-up data centres. The following table highlights key clauses under each policy.

Table 2: Current policy incentives for data centres

| Policy | Key Features |

|---|---|

| Maharashtra IT/ITeS Policy, 202325 | Provides power tariff subsidies and electricity duty exemptions to reduce operating costs. |

| Offers exemptions or waivers on stamp duty for land and project documentation. | |

| Guarantees continuous water supply. | |

| MAHITI portal to be used as a single-window mechanism for set-up processes and approvals. | |

| Karnataka Data Centre Policy (2022-2027)26 | Provides capital and land subsidies, stamp duty exemption, land conversion fee exemption, power tariff exemption, green power tariff reimbursement, and electricity duty exemption. |

| Relaxed and modified building norms. | |

| Tamil Nadu Data Centre Policy, 202127 | Single window facilitation to provide end-to-end facilitation support. |

| A training subsidy of up to ₹10,000/- per person trained per month (for up to 6 months) per data centre, capped at ₹1 crore per data centre. | |

| Exemption from stamp duty and electricity tax for 5 years. | |

| Exemptions from inspections under various Acts, notably the Maternity Benefit Act, Contract Labour (Regulation & Abolition) Act, Payment of Wages Act, Equal Remuneration Act, Employees Provident Fund Act, and Minimum Wages Act. | |

| Telangana Data Centre Policy, 201628 | Offers capital investment support, power subsidies, and stamp duty reimbursements. |

| Exemptions from inspections under various Acts, notably the Maternity Benefit Act (1961), Contract Labour (Regulation & Abolition) Act (1970), Payment of Wages Act (1936), and Minimum Wages Act (1948). | |

| Uttar Pradesh Data Centre Policy, 202129 | Offers 100 percent exemption on electricity duty and uninterrupted water supply. |

| Offers subsidies and exemptions on land purchase, stamp duty, and capital investment. | |

| Exemptions from inspections under various Acts, notably the Maternity Benefit Act (1961), Contract Labour (Regulation & Abolition) Act (1970), Payment of Wages Act (1936), and Minimum Wages Act (1948). | |

| West Bengal Data Centre Policy, 202130 | Offers 100 percent exemption on stamp duty, and a waiver on electricity duty. |

| Offers access to high speed internet and continuous supply of water and special provision in building norms. |

The draft Data Centre Policy31 published by the Ministry of Electronics and IT (MeitY) in 2020 has a similar aim as the state data centre policies, to incentivise data centre development. In addition to measures proposed in state data centre policies, the draft Data Centre Policy also seeks to establish Data Centre Zones to further streamline approval processes and regulatory compliance. However, this policy remains a draft as of September 2025. As a result, at the national level, the current policy approach is fragmented.

While this enables State Governments to focus on issues specific to their states with respect to the data centre ecosystem, the draft Data Centre Policy would also incentivise the development of data centres in other states and repurpose existing unused infrastructure as edge data centres, thereby expanding the market. As it stands, there is a significant gap between India’s domestic data production when compared with its data centre capacity. Moreover, the projections for India’s data centre capacity by 2030 vary significantly, from 5 to 17GW. While 5GW32 is a more achievable goal, 17GW33 is more desirable to grow the economy. The challenge then is to provide a realistic roadmap for 17GW capacity and work towards it, achieving at least a 10-12GW total capacity. Currently, there are some prominent medium-to-large data centre projects by Google, Reliance Industries, and Adani in the planning phase that could accelerate growth in the coming years.34 In addition to the draft Data Centre Policy, a consolidated strategy as outlined in a later section of this paper is necessary to meet infrastructure requirements for accelerating India’s data centre capacity growth.

The following subsections outline the 6 key elements of data centre infrastructure and their status in India.

Compute

Servers constitute the computational foundation of data centres, integrating processors (CPUs, GPUs), storage, and power. In AI-centric data centres, GPUs are critical due to their parallel processing capabilities, which are essential for training and inference in large-scale AI models.

Currently, there is a mix of government initiatives, strategic policy frameworks, and international partnerships to support compute for data centres. The IndiaAI Compute Portal exemplifies this effort, offering low-cost access to high-performance GPUs to researchers, startups, and public institutions. As of May 2025, the portal provides access to more than 34,000 GPUs.35 The GPUs are procured through public-private partnerships with AI compute providers like Yotta, E2E, CtrlS, etc. and include NVIDIA, AMD, Intel, and IBM chips.36

However, the Compute Portal remains severely underutilised, with just 144 users as of September 2025. Heavily-subsidised compute costs through this initiative risk distorting the market, as new entrants are unlikely to compete, leading to reduced competition and innovation in the sector. The artificially low pricing also highlights the fundamental issue of low demand for high-performance compute resources in India, suggesting that subsidy alone may not stimulate substantial research or commercial activity. When the government intervenes without genuine market failure, it can inadvertently create unnecessary bureaucratic layers for accessing infrastructure. As a result, the portal may not advance its goal of democratising access, but instead reinforce inefficiencies in the ecosystem.37

As India’s data centre capacity grows, the demand for compute will also increase proportionately. The supply chain for semiconductor chips is highly complex, distributed globally and has critical bottlenecks in several stages. These bottlenecks have become a geopolitical lever in the recent past and are being leveraged to control access to chips in the “AI race” between US and China. The Biden era AI diffusion framework instituted country wise caps on GPU procurement, which have now been repealed. For India, this underlines the urgency of diversifying supply chains, investing in indigenous capability-building, and strengthening partnerships to secure stable access to critical hardware.

India has demonstrated relative strengths in the design segment, with firms like Wipro, TCS, and HCL contributing to global chip design and electronic design automation (EDA) services. Recognising this, the government has introduced production-linked incentive (PLI) schemes and strategic programs to foster base-level capabilities in assembly, testing, packaging, and fabrication. However, large-scale self-sufficiency is still a long way off due to the extraordinary capital intensity of semiconductor fabs, dependence on global lithography equipment providers, and the deeply entrenched advantages held by established semiconductor economies such as Taiwan, South Korea, and the United States. While access to compute remains a potential bottleneck, as long as India is not limited in purchasing GPUs, it does not pose a significant risk.

Storage Systems

AI training and inference require high-performance, low-latency storage solutions, primarily High Bandwidth Memory (HBM) for extreme data throughput, and may also include Solid State Drives (SSD) for active data and Hard Disk Drives (HDD) for cold or archival storage. Currently, India lacks domestic manufacturing capabilities for all three storage systems.

This market is dominated by global storage firms such as Western Digital, Seagate, Samsung, Micron, and Intel. These companies supply directly or through enterprise storage solutions offered by Original Equipment Manufacturers (OEM) like Dell EMC, NetApp, and HPE. Most storage hardware used in Indian data centres is imported from Asia-Pacific countries (China, South Korea, Japan, Taiwan) or the U.S. Following the drastic increase in storage systems demand due to panic buying during the COVID-19 pandemic, post the pandemic, demand decreased as a result of many of these storage systems not being used. Production was then cut, and with the expected rise in demand in order to develop technologies such as AI, it is predicted that there will be a shortage of supply – particularly for HDDs, as there are only 3 companies producing HDDs today.38

The strengths of India’s storage ecosystem lie in its maturing system integration capabilities, with players like Netweb, VVDN, and HCL, and increasing proficiency in software-defined storage (software used to manage, provision, and control storage resources). Government support through the India Semiconductor Mission and its ATMP/OSAT schemes offers further indirect policy backing. India currently lacks indigenous production of NAND flash, HDDs, or even tape-based archival systems, and is almost entirely reliant on imports for enterprise-grade storage hardware. This does not, however, create a bottleneck for India’s data centre industry, since storage systems are general purpose and their exports have not been significantly restricted in the past.

Networking Equipment

High-performance networking infrastructure is foundational to the efficient operation of data centres, especially for AI workloads that demand high-throughput, low-latency connectivity between compute nodes, storage arrays, and external endpoints. Core components such as Layer 3 routers, 100G/400G Ethernet switches, and interconnects are essential to enabling AI model training and inference at scale.

At present, India is reliant on imports for its networking equipment. Global OEMs such as Cisco, Juniper, Arista, HPE, and Huawei dominate the Indian market, supplying the bulk of the switching and routing infrastructure used in data centres. Additionally, under the Design Linked Incentive (DLI) scheme, companies like VerveSemiconductors and Cyient are developing indigenous networking ASIC and design. Other indigenous players like HFCL and Tejas Networks are already active in optical and 5G transport networks.

Power

As AI workloads, particularly model training and inference, demand energy-intensive compute environments, ensuring reliable, high-quality, and sustainable power is essential. Assuming India’s data centre capacity is projected to reach 17 GW by 2030, power provisioning has emerged as both a technical and policy challenge.

The average CUF of a solar plant in the US is 25 percent, the highest being 29.1 percent for plants based in Arizona between 2014-17.39

While renewables like solar, wind, hydro, and nuclear are increasingly integrated to complement coal, their real contribution is limited by intermittency and varying capacity utilisation. For example, India’s solar power plants typically operate at a capacity utilisation factor (CUF) of around 16-20 percent,40 meaning that for every 100 MW of installed solar capacity, only about 16-20 MW is generated on average across the year. This stark difference between installed and effective capacity illustrates why renewables cannot address baseline data centre power needs. Moreover, India is a power-scarce country and despite having an installed power capacity of over 490 GW as of July 2025,41 frequent shortages and disruptions persist due to rapid demand growth, regional imbalances, and the uneven quality of supply.42

Data centres adding significant load to the main grid risk exacerbating existing pressures. India’s power transmission and distribution system also faces chronic challenges, with transmission and distribution (T&D) losses at approximately 16.64 percent in FY2023-2443 which is more than double the global average of 6-8 percent.44 T&D losses in India result in GDP losses of about 1-1.9 percent per year.45 These losses are compounded by factors such as outdated infrastructure, poor quality conductors, and commercial losses from theft and metering errors. Such systemic inefficiencies threaten not only the sustainability but also the reliability of power for the nation’s expanding digital infrastructure.

Criticalities in the power infrastructure in India include peak load stress in urban regions such as Mumbai, slow grid upgradation in Tier-2 and 3 cities targeted for edge data centres, limited domestic manufacturing of energy storage systems, and policy fragmentation across states. To avoid power outages affecting data centres, UPS, diesel generators, and Battery Energy Storage Systems need to be incorporated as part of data centre infrastructure. India’s policy approach to energy storage systems includes Energy Storage Obligations (ESO) to ensure that companies have adequate storage systems. ESOs “shall gradually increase from 1 percent in FY 2023-24 to 4 percent by FY 2029-30, with an annual increase of 0.5 percent” and will apply till at least 85 percent of the total energy stored is procured from Renewable Energy sources on an annual basis.46

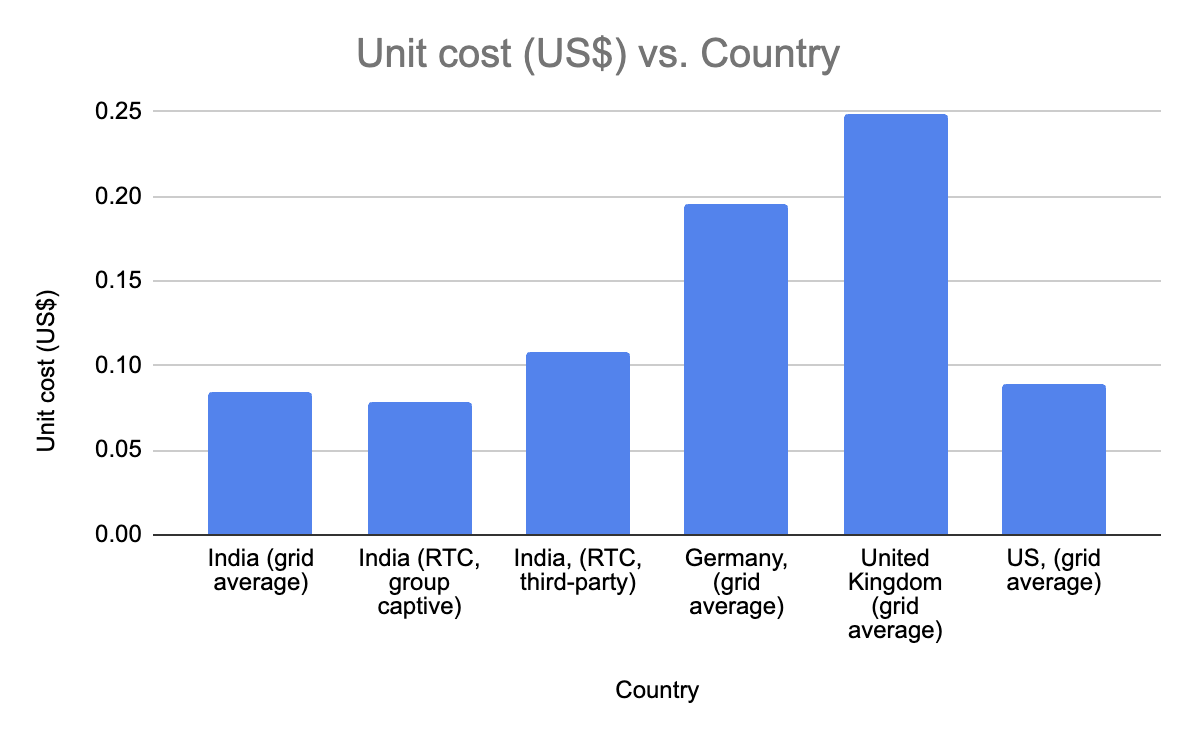

On comparison with countries such as the US, UK, and Germany, it is observed that the average cost of electricity in India is lower that that of Germany and the UK, and similar to that of the US.47 However, diesel generators increase the cost of electricity considerably. While the average cost of electricity from the main grid in India is US$ 0.085/kWh and round-the-clock renewables (RTC) is US$ 0.104-0.112, diesel generators cost US$ 0.28/kWh (see Table 3).48 As a result, relying substantially on diesel generators is not cost-effective and highlights the need to revamp India’s overall power infrastructure.

| Country | Unit cost (USD) | Annual costs (USD) |

|---|---|---|

| India (grid average) | 0.085 | 89.4 m |

| India (RTC, group captive) | 0.076-0.080 | 80-85m |

| India, (RTC, third-party) | 0.104-0.112 | 109-118 m |

| Germany, (grid average) | 0.196 | 205.5 m |

| United Kingdom (grid average) | 0.249 | 261.6 m |

| US, (grid average) | 0.0886 | 93.1 m |

Table 3: Unit cost and annual cost of electricity in different countries, as prepared by Renuka Sane on ‘The Leap Blog’.49

The National Electricity Plan (NEP) 2023 and India’s 500 GW renewable target by 203051 offer long-term resilience, but dedicated AI-specific data centre power corridors and local energy storage manufacturing are essential to meet AI growth sustainably. India is also exploring Small Modular Reactors (SMRs) as part of its clean energy transition, though development is still at an early stage. With a current nuclear capacity of 8 GW,52 India aims to expand to 22 GW by 2031-32.53 SMRs are being considered for their scalability, safety, and suitability for decentralised power, including for industrial clusters and data centres. The NITI Aayog and Department of Atomic Energy (DAE) have signalled policy interest,54 and India is seeking global partnerships for technology transfer. However, commercial deployment of SMRs remains several years away, pending regulatory approval and indigenous capability development.

The fundamental cause for concern is not one that can be solved entirely via data centres. The power grid in India needs to be upgraded to be able to sustain high transmission capacity and support the integration of diverse power sources. Improvements in grid robustness, smart grid adoption, and infrastructure quality are essential for supporting India’s future digital and economic growth sustainably. Development of the India Energy Stack as part of Digital Public Infrastructure is also underway, which will help standardise and enable interoperability across the energy supply chain.55

Water

AI data centres consume substantial water, particularly through evaporative and adiabatic cooling systems, which uses around 25.5 million litres of water in a 1 MW data centre annually,56 equivalent to the annual water consumption by 500 people (per person per day consumption is 135 litres).57 In a country like India which has 18 percent of the global population but only 4 percent of freshwater resources, this dependence poses sustainability concerns, since traditional cooling methods require freshwater.

NITI Aayog’s Composite Water Management Index58 warns that 21 Indian cities (including Delhi, Bengaluru, and Hyderabad) could exhaust their groundwater supplies by 2030. States like Maharashtra, Telangana, and Tamil Nadu, where major data centre clusters are emerging, are already under severe water stress. This raises critical challenges for the long-term viability of AI infrastructure in these regions.

At the national level, the National Water Policy (2012)59 outlines broad principles for sustainable use but lacks specific directives for industrial sectors like data centres. Most data centres still rely heavily on groundwater, with limited reuse of greywater or integration into urban wastewater systems. However, state-level action is gaining traction. Maharashtra, Karnataka, and Uttar Pradesh have introduced green data centre policies that promote water-efficient technologies such as air-based cooling, closed-loop systems, rainwater harvesting, and the use of treated sewage water.

Real Estate

AI data centres require large, well-connected land parcels with proximity to power, water, and high-speed fibre networks. Hyperscale facilities typically need 10-50 acres depending on scalability. However, India faces multiple land-related constraints such as high land costs in Tier-1 cities, complex acquisition procedures, and inconsistencies in zoning and environmental regulations.

To address these, the draft Data Centre Policy (2020) has designated data centres as infrastructure, enabling smoother acquisition, faster clearances, and access to single-window permissions. Several state governments including Maharashtra, Tamil Nadu, Telangana, Uttar Pradesh, and Karnataka have adopted dedicated data centre policies. These often provide concessional land in industrial parks or tech zones, along with pre-approved infrastructure like power connections and fibre-ready access.

Special Economic Zones (SEZs) and industrial corridors like the Delhi-Mumbai Industrial Corridor (DMIC) and Chennai-Bengaluru Industrial Corridor (CBIC) are also being earmarked for AI-linked infrastructure, including chip fabrication, networking equipment manufacturing, and advanced cooling systems. Cities such as Hyderabad, Chennai, and Pune are leveraging their existing SEZs and IT parks for data centre development.

However, land prices in urban cores are skyrocketing, and clearance procedures for land conversion and environmental approvals remain lengthy. The lack of Tier-2 and Tier-3 city readiness for AI infrastructure, uncoordinated urban sprawl, and encroachment issues further complicate planning. Despite emerging clusters in locations like Gujarat International Finance Tec-City (GIFT City), Dholera, and Vizag, which are often near renewable energy or port hubs, Renewable Energy Zones (REZs) are frequently located far from AI demand centres such as Mumbai.

Strategies like vertical zoning for urban data centres, brownfield redevelopment of defunct SEZs, and development of shared Data Centre Parks with centralised cooling, fibre, and power infrastructure are gaining traction. India is projected to require an additional 45-50 million square feet of data centre real estate to meet AI demand.60 Moreover, edge and micro data centres are gaining popularity as they require lesser resources to build but are located closer to Tier-2 and Tier-3 cities, thereby decentralising the ecosystem and reducing latency.

What should be India’s strategy?

Currently, developing data centre capacities play a key role in formulating infrastructure-building strategies. However, there is limited local demand for Indian data centres, as most Indian companies already rely on established foreign cloud service providers. Forcing local demand through broad data localisation mandates could hinder free trade and increase compliance costs, with potential negative economic impacts, whereas without demand, data centres would remain underused.61 The IndiaAI Compute portal remains underutilised as of August 2025 as well.62 However, as was previously established, developing a robust domestic data centre infrastructure is crucial for improving national capabilities, especially in critical sectors and for digital inclusion. India can leverage it’s relatively lower costs for building data centres as well as other favourable environmental conditions to incentivise investments.

The previous sections highlighted a major bottleneck with respect to developing data centres in India, i.e. inadequate power infrastructure. In order to reliably power data centres while avoiding grid overloads as capacity and demand increases, there are three options:

Captive power plants for large data centres (>100 MW): Data centres with more than 100 MW installed capacity could be required to build captive power plants. Given that India’s current data centre facilities have a capacity generally under 10 MW, this option would be more relevant in the future when capacities increase substantially, as is planned. Captive power plants could help ensure reliable, high-quality power independent of grid constraints in the long term. However, the costs of captive power plants might be higher than grid power for commercial use.

Proportional investments in NTPC bonds for medium and large data centres (>5 MW): Requiring data centres with installed capacities exceeding 5 MW to invest proportionally in NTPC’s energy bonds offers a practical near-term solution. These bonds channel capital into grid-scale energy and this model guarantees more reliable power to data centres by fostering stable clean energy as well as non-renewable energy development. This mobilises private investment in power infrastructure development without invoking direct government subsidies, and bondholders earn financial returns. This creates a positive feedback loop where data centres indirectly contribute to strengthening overall grid capacity and resilience.63

Power tariffs that cross-subsidise increased demand: Increasing tariffs for data centres to cross-subsidise additional demand growth, mimicking existing frameworks applied to industrial and commercial users, could help contain costs borne by other consumers. However, this option risks disincentivising investment in the data centre sector due to increased operational expenses, potentially slowing digital infrastructure growth.

Of the above options, requiring data centre operators to invest in NTPC bonds is the most strategic and immediately practical way forward. Proceeds from these bonds are specifically earmarked for expanding India’s capacity in grid-scale renewables and upgrading the main grid, directly supporting national energy goals. This approach mobilises significant private capital for energy infrastructure projects without imposing a direct fiscal burden on the state, ensuring that growth in the digital sector is aligned with decarbonisation pathways. Furthermore, data centre operators gain the advantage of a stable financial return from these bonds as well as reliable power access, while their investments help build out India’s energy capacity. This indirectly enhances grid reliability and reduces long-term risks of power shortages as demand surges.

In addition to challenges with the power infrastructure, India’s other key challenges are the lack of competitiveness of smaller players relative to hyperscalers, a lack of domestic demand, and water shortage. As a result, it is essential to focus data centre development on the following areas:

The following strategies can also be implemented to increase data centre demand and improve access to necessary infrastructure:

Critical sectors like defence, finance, and health: Sectors where data localisation is necessary for national security can help boost domestic demand for data centres.

Partner with other countries to establish data embassies in India: Data embassies are data centres set up by states in other countries, which leverage advanced cybersecurity measures. They are intended as a back-up in case of natural calamities, cyber threats, and geopolitical risks in the home country. Countries such as Singapore are interested to establish data embassies in India,64 which is currently being facilitated in GIFT City.65

Improving digital connectivity outside Tier 1 cities: Given India’s size and disparity in access to technology, this is an opportunity for India to accelerate digital connectivity in Tier 2 and Tier 3 cities as well as rural areas. This would also help improve entrepreneurship in this industry and promote the development of indigenous AI models by improving access to diverse data.

Improving access to compute: Partnerships for chip design, fabrication, and the procurement of chips can be set up with countries such as the US, Taiwan, South Korea, Japan, Singapore, Malaysia, and Germany.

Public-private partnerships (PPP) for R&D: Restrict direct government intervention to setting up PPPs for critical sector data centres and R&D for sustainable data centre development, particularly with respect to cooling technologies.

Establish centralised regulatory frameworks for baseline efficiency in water, power, and land use: This will help ensure long-term sustainability and compliance with environmental standards across states while keeping compliance costs minimum.

Conclusion

In conclusion, while India’s progress in AI and digital transformation is often acknowledged, the foundational importance of a robust domestic data centre ecosystem for overall economic development must not be underestimated. Despite producing a significant portion of the world’s data, India’s data centre capacity remains disproportionately low, highlighting a strategic gap. To ensure competitiveness, the development of domestic data centres must be seen as a strategic national priority, not only to store and process data, but to support indigenous AI innovation and become a vital node in the global AI value chain.

The global data centre industry is characterised by high capital requirements, economies of scale, strong network effects, and complex regulatory and technical barriers, all of which concentrate the market and inhibit the emergence of new domestic players. This reality accentuates the need for deliberate policymaking, market development, and skill-building if India is to establish geopolitically strategic digital infrastructure. Furthermore, India’s existing power and water infrastructure are insufficient to be able to handle high data centre capacities in the future. These must be developed in tandem with data centres.

This paper has laid out the foundational components of data centre infrastructure and assessed the current gaps in demand generation and infrastructure. To catalyse meaningful growth, India must modernise its power infrastructure to be able to supply continuous and reliable power through a mix of renewable and non-renewable sources. Strategic multilateral and bilateral partnerships can encourage investments, technology transfer, and shared R&D, positioning India as both a consumer and contributor to global AI progress. Lastly, regulations around water use are necessary to ensure more efficient use of the same, given current water scarcity. In doing so, India can move beyond reactive infrastructure building toward a proactive, demand-aligned data centre ecosystem that is resilient and globally competitive.

Footnotes

Jatin Shah and Vimal Nadar, “India’s DC capacity to cross 4,500 MW by 2030 as USD 20-25 billion of future investments likely to materialize”, Colliers, May 28, 2025.↩︎

Niccolo Conte, “Charted: The Growth of Global Data Center Capacity (2005–2025)”, Visual Capitalist, July 2, 2025.↩︎

Konstantin Pilz, Robi Rahman, James Sanders and Lennart Heim, “GPU Clusters”, Epoch AI, October 09, 2025.↩︎

Jatin Shah and Vimal Nadar, “India’s DC capacity to cross 4,500 MW by 2030 as USD 20-25 billion of future investments likely to materialize”, Colliers, May 28, 2025.↩︎

Saurav Anand, “India’s data center capacity to surge to 17 GW by 2030; $27 billion invested in last three years”, ETEnergyWorld, July 16, 2024.↩︎

“NVIDIA H100 Tensor Core GPU”, NVIDIA.↩︎

Karthik Ramachandran, Duncan Stewart, Kate Hardin, Gillian Crossan and Ariane Bucaille, “As generative AI asks for more power, data centers seek more reliable, cleaner energy solutions”, Deloitte, November 19, 2024.↩︎

David Mytton, “Data centre water consumption”, npj Clean Water, February 15, 2021.↩︎

“Per Capita Availability of Water”, PIB, March 2, 2020.↩︎

“What are the power usage effectiveness (PUE) ratings for major data centers in India?”, Cyfuture Cloud.↩︎

Karthik Ramachandran, Duncan Stewart, Kate Hardin, Gillian Crossan and Ariane Bucaille, “As generative AI asks for more power, data centers seek more reliable, cleaner energy solutions”, Deloitte, November 19, 2024.↩︎

Azdhan, “Microsoft-Nayara Incident Shows Why India Shouldn’t Rely on Foreign Technologies”, Medianama, August 1, 2025.↩︎

Ashwin Prasad, Bharath Reddy and Rijesh Panicker, “The AI Diffusion Framework Was Repealed. What Does This Mean For India?”, Takshashila Institution, July 4, 2025.↩︎

PTI, “Data centre development cost in India at $7 per Watt among global lowest, shows strong growth potential: Report”, The Hindu Businessline, September 16, 2025.↩︎

Jitesh Karlekar, “India Data Centre Market Dynamics”, JLL, 2024.↩︎

“State of the Economy: Getting Back into the Fast Lane”, Economic Survey 2024-2025, 2025.↩︎

Abhinandan Mishra, “India’s power sector bleeds, loses 16.64% energy”, The Sunday Guardian, July 27, 2025.↩︎

“Electric power transmission and distribution losses (% of output)”, World Bank Group, March 25, 2025.↩︎

Wesley Spindler, Luna Atamian Hahn-Petersen and Sadaf Hosseini, “Why circular water solutions are key to sustainable data centres”, World Economic Forum, November 7, 2024.↩︎

Leonardo Nicoletti, Michelle Ma and Dina Bass, “AI Is Draining Water From Areas That Need It Most”, Bloomberg Technology + Green, May 8, 2025.↩︎

Dan Swinhoe, “Colt acquires land in Navi Mumbai for 100MW data center – report”, Data Center Dynamics, July 18, 2024.↩︎

Payal Malik, Bhargavee Das and Harishankar Thayyil Jagadeesh, “A Competition Analysis of the Indian Cloud Computing Market”, ICRIER, August 2024.↩︎

“Infrastructure for today and tomorrow”, Meta, 2025.↩︎

Reuters, “OpenAI, Oracle deepen AI data center push with 4.5 gigawatt Stargate expansion”, The Hindu, July 23, 2025.↩︎

“New Information Technology and Information Technology Enabled Services Policy of Maharashtra State-2023”, Enclosures of IE&LD Government Resolution No.ITP-2021/CR-170/Ind-2, June 27, 2023.↩︎

“Karnataka Data Centre Policy 2022-27”, Department of Information Technology - Government of Karnataka, 2022.↩︎

“Tamil Nadu Data Centre Policy 2021”, Department of Information Technology - Government of Tamil Nadu, 2021.↩︎

“Data Centres Policy 2016”, Information Technology, Electronics & Communications Department - Government of Telangana, 2016.↩︎

“Uttar Pradesh Data Center Policy 2021”, Department of IT & Electronics - Government of Uttar Pradesh, 2021.↩︎

“West Bengal Data Centre Policy 2021”, Department of Information Technology & Electronics - Government of West Bengal, 2021.↩︎

“Data Centre Policy 2020”, Ministry of Electronics & Information Technology, 2020.↩︎

Saurav Anand, “India’s data centre capacity to reach 5 GW by 2030, capex to cross $22 billion: Report”, ETEnergyWorld, July 22, 2025.↩︎

Saurav Anand, “India’s data center capacity to surge to 17 GW by 2030; $27 billion invested in last three years”, ETEnergyWorld, July 16, 2024.↩︎

Nivash Jeevanandam, “India’s AI-powered data centre boom - $100 billion investment forecast by 2027: CBRE”, IndiaAI, December 18, 2024.↩︎

“India’s Common Compute Capacity Crosses 34,000 GPUs”, PIB, May 30, 2025.↩︎

“IndiaAI Compute Capacity”, IndiaAI, 2025.↩︎

Rijesh Panicker and Bharath Reddy, “India’s AI compute conundrum”, The Hindu, April 28, 2025.↩︎

Jeremy Hillpot, “Could a Hard Drive Supply Chain Crisis Push AI and Digital Ads to the Breaking Point?”, Hackernoon, September 28th, 2023.↩︎

“Southwestern states have better solar resources and higher solar PV capacity factors”, EIA, June 12, 2019.↩︎

Satish Kumar Yadav and Usha Bajpai, “Performance evaluation of a rooftop solar photovoltaic power plant in Northern India”, ScienceDirect, February 3, 2018.↩︎

“India Climate & Energy Dashboard”, NITI Aayog, 2025.↩︎

Eric Koons, “Energy Crisis In India: What’s Next?”, Energy Tracker Asia, November 7, 2024.↩︎

Abhinandan Mishra, “India’s power sector bleeds, loses 16.64% energy”, The Sunday Guardian, July 27, 2025.↩︎

“Electric power transmission and distribution losses (% of output)”, World Bank Group, March 25, 2025.↩︎

Kamalika Ghosh, “How Power Cuts Are Sucking Life Out Of Indian Economy”, Outlook Business, July 7, 2023.↩︎

“Energy Storage Systems(ESS) Overview”, Ministry of New and Renewable Energy, 2025.↩︎

Renuka Sane, “Powering AI with Reliable Grids and Networks”, The Leap Blog, September 01, 2025.↩︎

Renuka Sane, “Powering AI with Reliable Grids and Networks”, The Leap Blog, September 01, 2025.↩︎

Renuka Sane, “Powering AI with Reliable Grids and Networks”, The Leap Blog, September 01, 2025.↩︎

Renuka Sane, “Powering AI with Reliable Grids and Networks”, The Leap Blog, September 01, 2025.↩︎

“National Electricity Plan”, Central Electricity Authority, Extraordinary Gazette No. 3189, Sl. No. 329, May 31, 2023.↩︎

“India Climate & Energy Dashboard”, NITI Aayog, 2025.↩︎

“Nuclear Power in Union Budget 2025-26”, PIB, February 3, 2025.↩︎

Rajashekhar Malur et al., “A Report on the Role of Small Modular Reactors in the Energy Transition”, NITI Aayog, May 2023.↩︎

“Constitution of Task Force for developing the Roadmap for India Energy Stack and PoC for Utility Intelligence Platform”, Ministry of Power, No.12/07/2022-UR&SI-II-Part(3)-(E-277336), June 27, 2025.↩︎

David Mytton, “Data centre water consumption”, npj Clean Water, February 15, 2021.↩︎

“Per Capita Availability of Water”, PIB, March 2, 2020.↩︎

“Composite Water Management Index”, NITI Aayog, August 2019.↩︎

“National Water Policy (2012)”, Ministry of Water Resources, 2012.↩︎

“Attracting AI Data Centre Infrastructure Investment in India”, Deloitte, May 2025.↩︎

Anirudh Burman and Upasana Sharma, “How Would Data Localization Benefit India?”, Carnegie India, April 14, 2021.↩︎

Rijesh Panicker and Bharath Reddy, “India’s AI compute conundrum”, The Hindu, April 28, 2025.↩︎

Divya Patil, “India’s top state green energy firm mulls first local bond sale”, The Economic Times, August 5, 2025.↩︎

Avinash Nair, “Singapore “actively looking” to set up Data Embassy in GIFT City: IFSCA official”, The Hindu Businessline, February 10, 2025.↩︎

“Amendments to the Banking Regulation Act, the Banking Companies Act and the Reserve Bank of India Act proposed to improve bank governance and enhance investors’ protection”, PIB, February 1, 2023.↩︎