China’s dominance as a global supplier of solar panels is no longer a surprise but the exports of clean technologies from China are finding new markets. Export data of the new energy sector from 2025 suggests diversification of export markets. China now exports a wide range of clean tech equipment and their components to both advanced manufacturing economies and emerging economies.

Solar Photovoltaic Cells and Modules

The Netherlands is the largest market for assembled Photovoltaic modules and panels from China. This is mainly due to its role as a major transshipment hub for the wider European Union, where policy support and ambitious renewable energy targets are driving the demand for solar installations. However, PV cells are largely absorbed by Indonesia and India with exports valued at approximately USD 234 million and USD 180 million respectively.

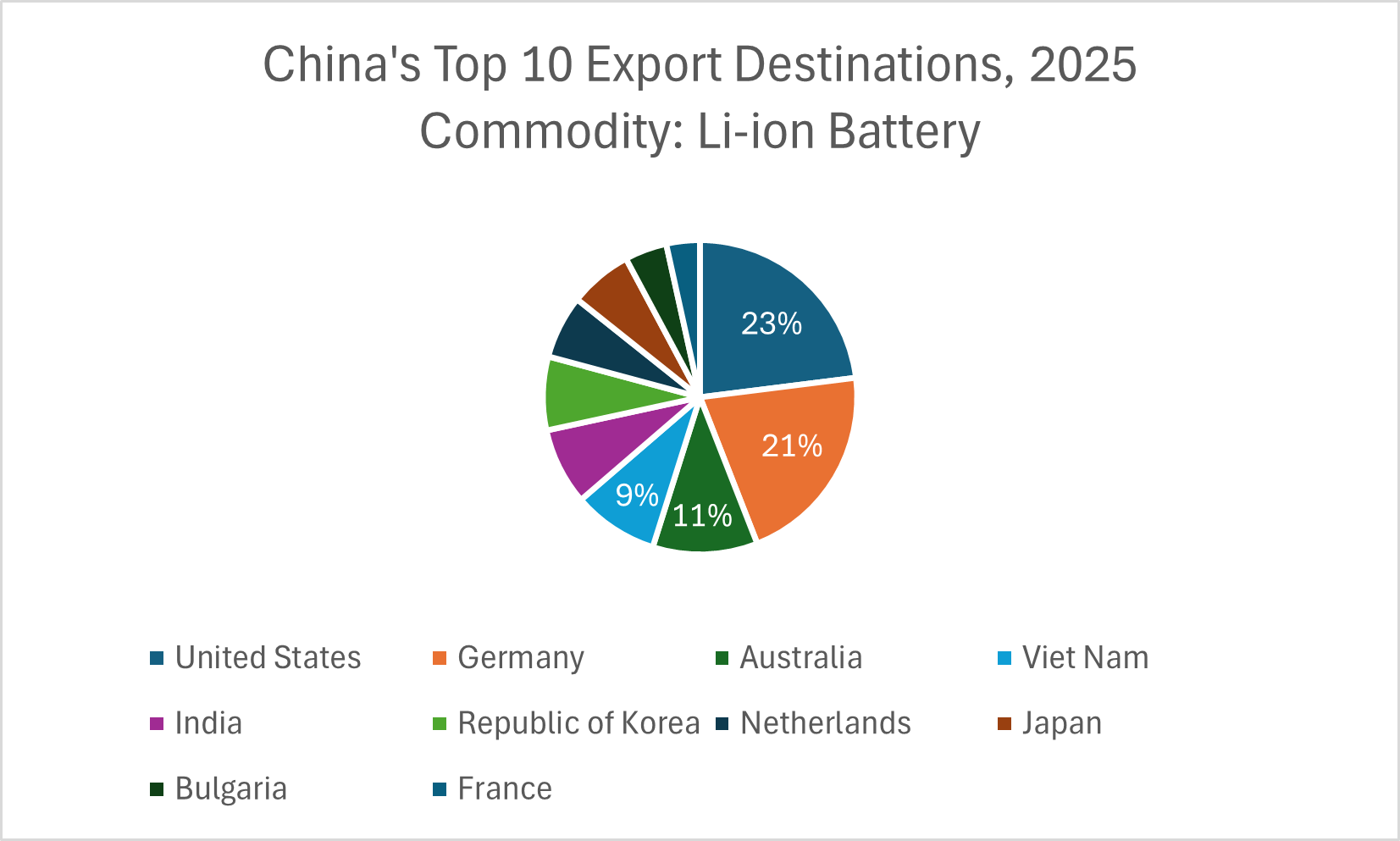

Lithium-ion batteries

Lithium-ion batteries have been one of the focus areas of China’s ‘new three’ policy. Currently facing overcapacity along with the EV sector, Chinese battery makers are keen on finding new markets for their products. Majority of the Lithium-ion battery exports are diverted towards advanced manufacturing economies where Chinese batteries are integrated into local supply chains or energy storage projects. Exports to the US account for USD 1 Billion, and that to Germany is about USD 94 million. This suggests the ability of Chinese firms to meet the higher quality demands from these markets while remaining competitive. However, Vietnam and India have also seen a rising demand for the same, driven by an increasing demand for affordable EVs.

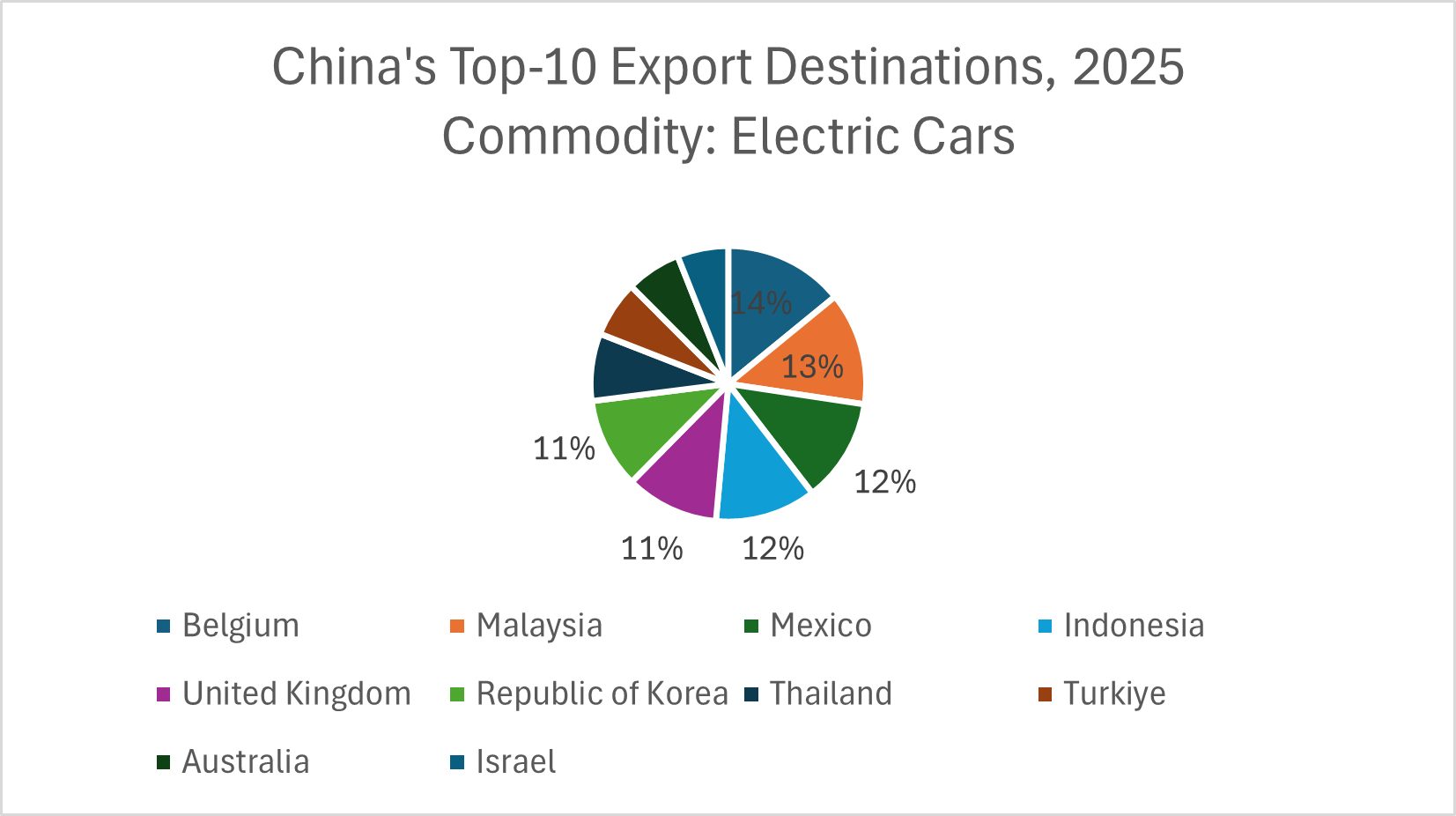

Electric Cars

Electric Vehicles (EVs), another key component of the ‘new three’ policy, are finding strong markets in emerging economies such as Malaysia and Indonesia. These economies are a growing market for EVs with minimal or no local competitors allowing Chinese EV makers to leverage their competitive advantage while providing higher quality products in these markets.

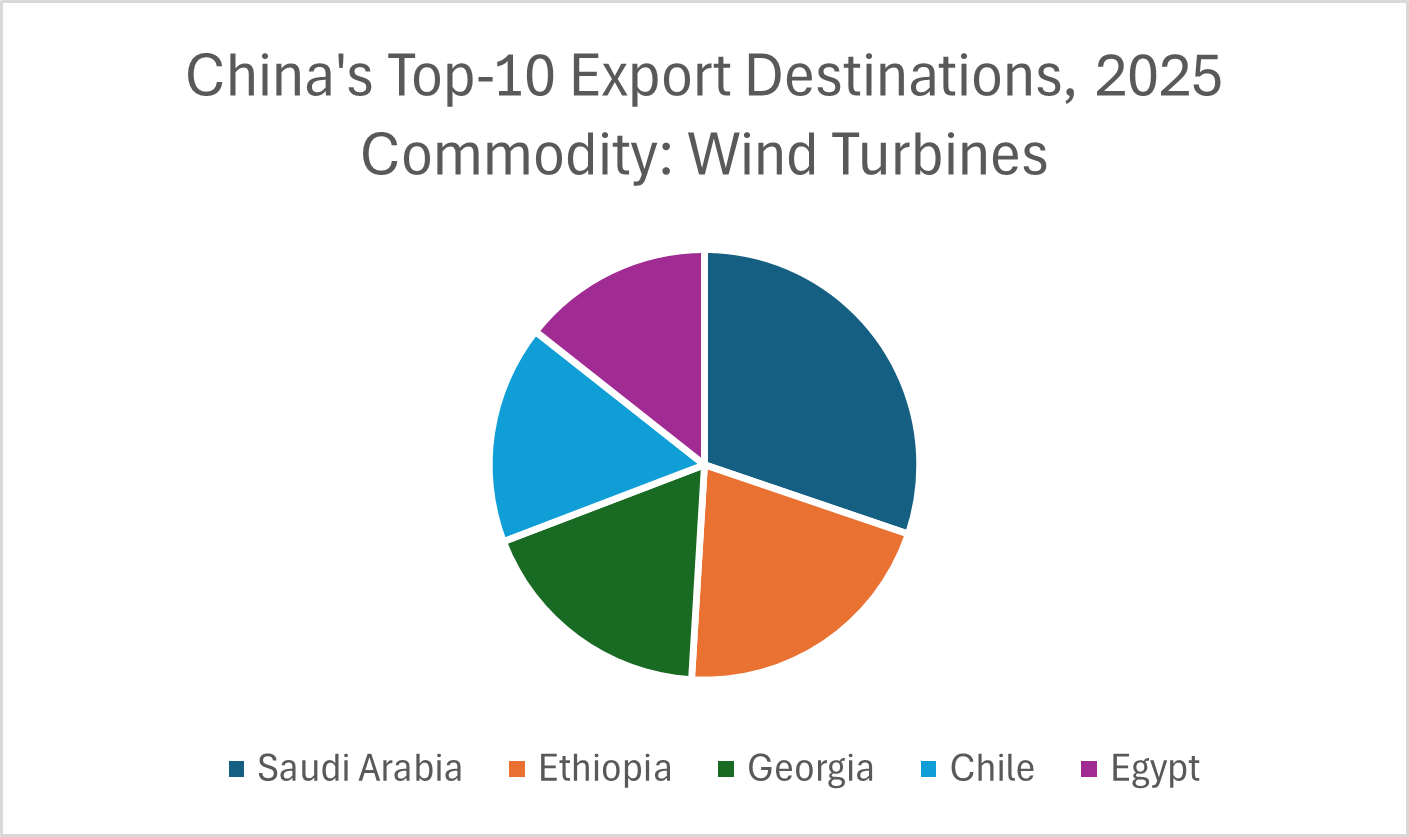

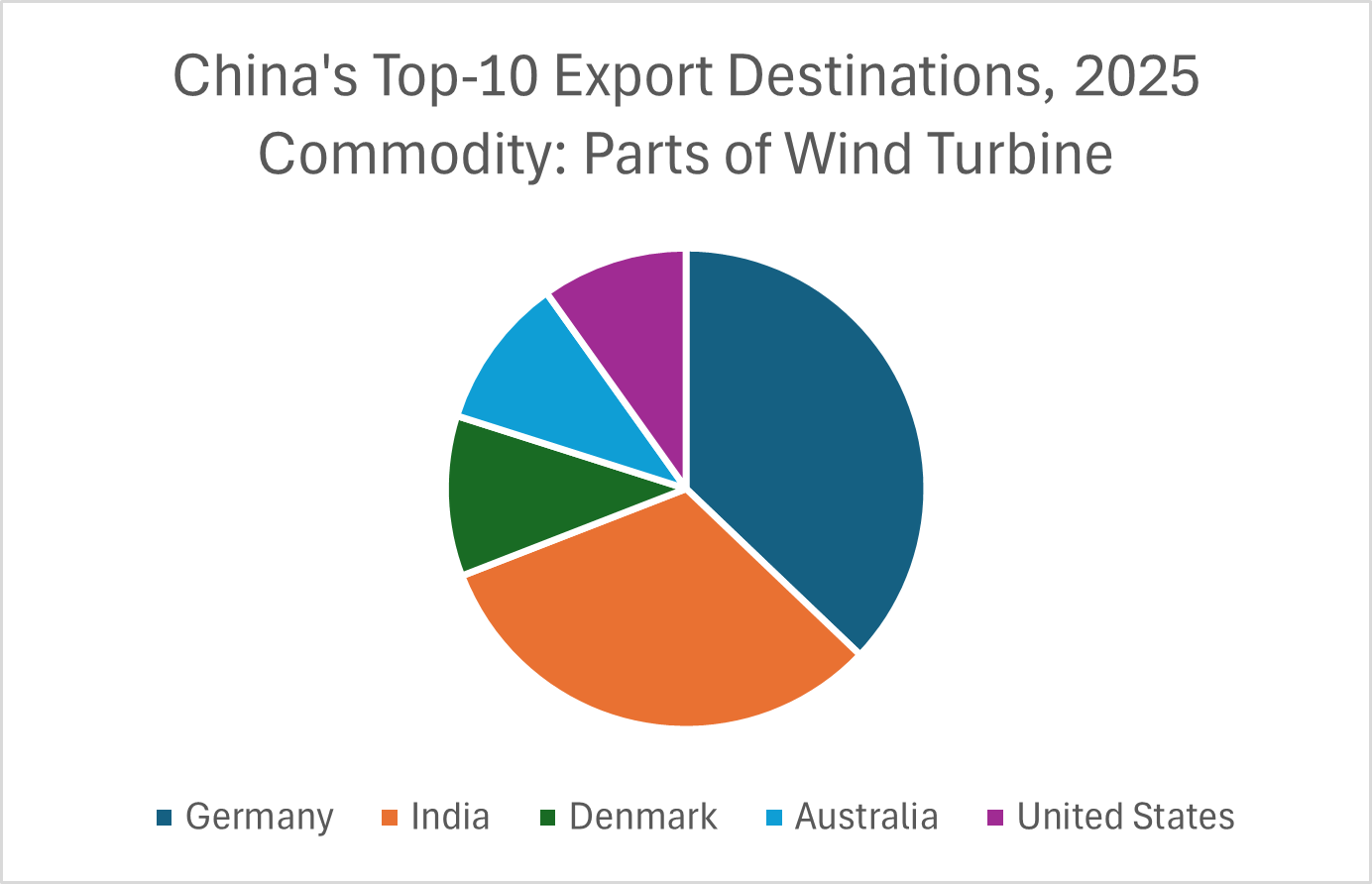

Wind Turbines and Parts thereof

A distinction of markets also exists in the exports of wind turbines and their parts. Top 5 export destinations for wind turbines, small and large, are Saudi Arabia, Ethiopia, Georgia, Chile, Egypt. This perhaps indicates a larger number of wind farm projects being taken up by Chinese contractors in these countries, which then utilise turbines supplied by Chinese firms. For parts and components of wind turbines, Germany and India are the largest markets accounting for about USD73 million and USD63 million of exports respectively.

The diversification of Chinese exports has come about due to domestic overcapacity in most of these sectors but it also reflects China’s industrial might and success of the ‘going global’ strategy by Chinese firms. It has become the primary supplier of technologies that are crucial for energy transition, and has played a large role in accelerating the adoption of these technologies by bringing down the costs. While this industrial might was largely enabled by subsidies and tax exemptions, the exports are embedding Chinese firms, standards and cost structures at the core of global energy transition.

Data Source: General Administrations of Customs of the People’s Republic of China.