If the FY 2025-26 Union Defence Budget was a status quo exercise, the Defence Budget for FY 2026-27, presented today, shows aspects of definitive transformation. Against the backdrop of the recent Operation Sindoor and the persistent anxiety regarding the China border, the Finance Ministry has broken some shackles of incrementalism, especially in the case of Capital Outlay.

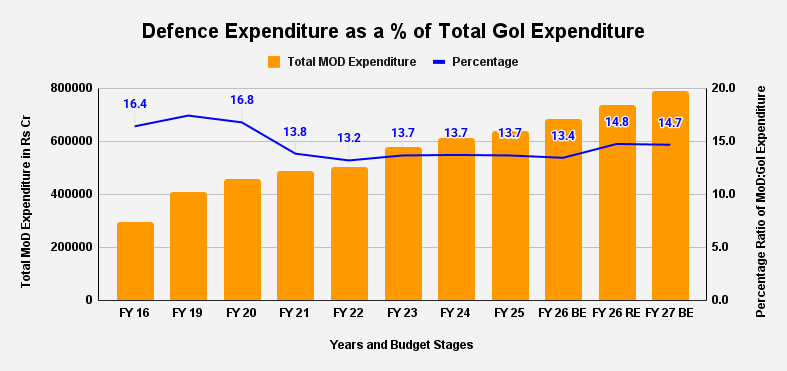

The total Defence Budget has hit a record ₹7.85 lakh crore, constituting 14.7% of total Central Government expenditure for the FY 27 Budget Estimate (BE). While it hovers just around the 2% of GDP mark, the composition of this spending reveals a shift in India’s military planning, in that, for the first time in this decade, the focus has decisively shifted from revenue expenditure to capital firepower (though the ratio as a percentage of total Defence expenditure between capital outlay and salaries + pensions remains 27:43).

Capital Outlay: The Absolute 21% Leap

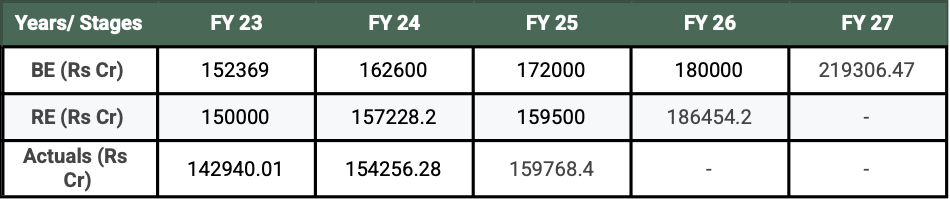

The headline story of this budget is the Capital Outlay. As per the budget documents (see Table 1), the allocation for capital expenditure = the money used to buy fighter jets, submarines, drones, and surveillance satellites - has jumped to ₹2,19,306.47 crore.

This is not a token increase. In FY 26, the hike was a meager 4.6%. This year, the jump from the FY26 Budget Estimate (BE) of ₹1,80,000 crore to FY27 BE is a staggering 21.8%. Even when compared to the Revised Estimates (RE) of FY26 (₹1,86,454 crore), one is looking at an accelerated injection of funds.

This surge suggests that the Ministry of Defence (MoD) is no longer just planning for modernisation but is now in the execution phase of major big-ticket contracts—likely the AMCA fighter program, the Project 75(I) submarines, and the massive drone induction necessitated by lessons learned from recent skirmishes. The hope is that there is no surrendering unspent capital funds, since the increased fund should ideally be used not just for committed liabilities, which have held down modernisation in the past years, but also for funding Emergency Procurement (EP) programmes.

The “Agnipath Effect”

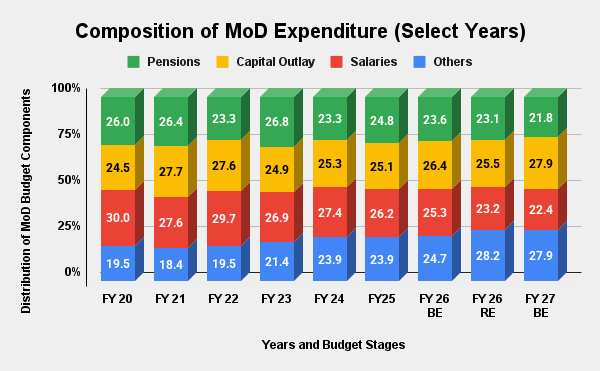

For years, defence analysts have warned that ballooning pension and salary bills were eating into the modernization budget. The composition of the MoD expenditure for FY 27 (see Figure 2) offers the first concrete sign that the tide is turning.

In FY 2020, pensions and salaries combined consumed over 56% of the defence budget. In FY 27, that combined figure has dropped to 44.2% (21.8% for pensions and 22.4% for salaries).

While the absolute pension bill remains high, its share of the pie is shrinking, likely a preliminary result of the Agnipath scheme and a deliberate policy to cap revenue expenditure.

Indigenisation Meets Reality

With ₹2.19 lakh crore in the kitty for capital assets, the pressure now shifts to the domestic industry. The government has reportedly reserved nearly 75% of this capital acquisition budget for the domestic industry under the Aatmanirbhar Bharat initiative.

The challenge, however, remains absorption capacity. Can our Defence PSUs and private sector players deliver on time? The “Buy Indian-IDDM” (Indigenously Designed, Developed, and Manufactured) route is noble, but the recent operational urgencies dictate that delivery timelines cannot be flexible. The heavy allocation suggests that the government is confident in the maturing of the Indian defence industrial base, particularly in ammunition, artillery, and electronics.

Acknowledgements: The author is grateful to Pranay Kotasthane for his research guidance and consistent data retention endeavours.